For the 24 hours to 23:00 GMT, the EUR rose 0.49% against the USD and closed at 1.1841, shrugging off downbeat economic releases across the Euro-zone.

Data showed that the Euro-zone’s seasonally adjusted construction output slid 0.4% on a monthly basis in October, dropping for the first time in seven months. Construction output had risen 0.1% in the previous month.

Separately, Germany’s Ifo business climate index unexpectedly eased to a level of 117.2 in December, as German Chancellor, Angela Merkel’s efforts to form a stable government clouded the nation’s economic outlook. The index had registered a revised record high level of 117.6 in the previous month, while markets were expecting for a drop to a level of 117.5. Moreover, the nation’s Ifo business expectations index declined more-than-anticipated to a level of 109.5 in December, compared to market expectations for a drop to a level of 110.7. The index had registered a reading of 111.0 in the previous month.

On the other hand, the nation’s Ifo current assessment index climbed to a level of 125.4 in December, exceeding market expectations for a rise to a level of 124.7, suggesting that firms were more optimistic about their current economic situation. The index had registered a reading of 124.4 in the prior month.

The greenback gained ground against most of the major currencies, amid growing expectations that the US House of Representatives would pass the US tax reform bill.

Gains in the US Dollar were further boosted, after data indicated that housing starts in the US unexpectedly climbed 3.3% on monthly basis to an annual rate of 1297.0K in November, surging to its highest level since October 2016, amid a spike in single-family home construction. Housing starts had registered a revised level of 1256.0K in the previous month, while markets were anticipating for a fall to a level of 1250.0K. On the contrary, the nation’s building permits fell 1.4% on a monthly basis to an annual rate of 1298.0K in November, compared to a revised reading of 1316.0K in the prior month, while market participants had envisaged for a drop to a level of 1270.0K.

In the Asian session, at GMT0400, the pair is trading at 1.1846, with the EUR trading marginally higher against the USD from yesterday’s close.

Meanwhile, the US House of Representatives approved the biggest US tax overhaul in 30 years.

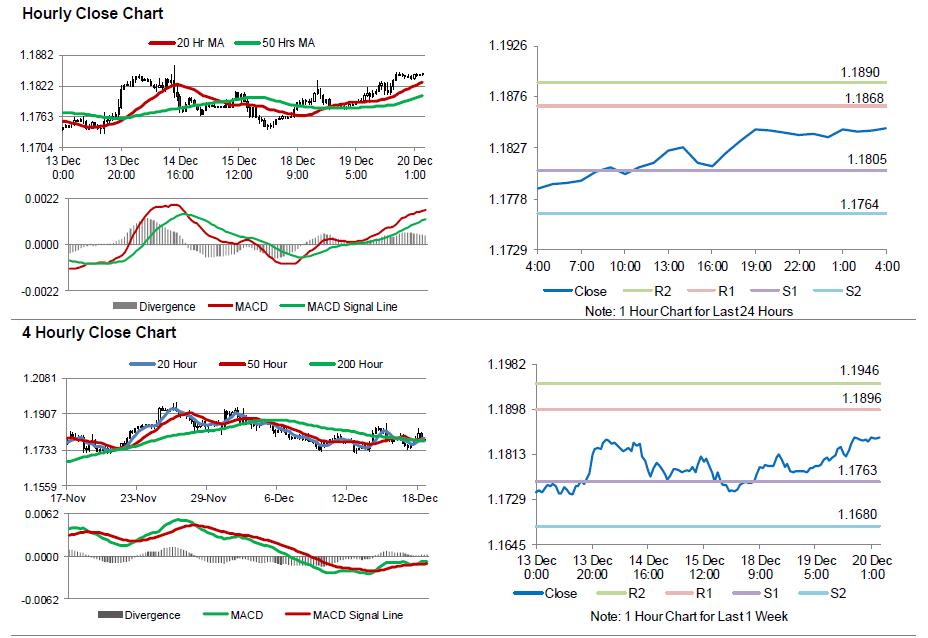

The pair is expected to find support at 1.1805, and a fall through could take it to the next support level of 1.1764. The pair is expected to find its first resistance at 1.1868, and a rise through could take it to the next resistance level of 1.1890.

Moving ahead, traders would focus on Germany’s producer price index for November, slated to release in a few hours. Moreover, the US existing home sales for November and weekly MBA mortgage approvals data, both set to release later in the day, will garner significant amount of market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.