For the 24 hours to 23:00 GMT, the EUR declined 0.43% against the USD and closed at 1.0446.

Macroeconomic data indicated that Germany’s Ifo business climate index rose to a level of 111.0 in December, notched its highest level since February 2014, thus adding to signs that the Euro-zone’s largest economy is regaining momentum. Meanwhile, markets expected the index to rise to a level of 110.6, following a level of 110.4 in the previous month. Additionally, the nation’s Ifo business expectations index advanced to a level of 105.6 in December, in line with market expectations. The index had recorded a level of 105.5 in the previous month. Further, the nation’s Ifo current assessment index climbed to a level of 116.6 in December, surpassing market expectations of a rise to a level of 115.9 and after recording a level of 115.6 in the prior month.

Separately, according to the Bundesbank monthly report, Germany’s economic growth is expected to have accelerated significantly in the fourth quarter, whilst inflation may even exceed 1.0% in December, following higher oil prices.

The US Dollar gained ground, after the US Federal Reserve (Fed) Chairwoman, Janet Yellen, painted an upbeat picture of the US labour market.

The Fed Chair, Janet Yellen, in a speech at the University of Baltimore, stated that the US labour market has improved to its strongest in nearly a decade, indicating that wage growth is picking up.

On the data front, the US flash Markit services PMI unexpectedly fell to a level of 53.4 in December, suggesting a slowdown in the nation’s services sector. The PMI had recorded a level of 54.6 in the prior month, while defying market anticipations for the index to rise to a level of 55.2.

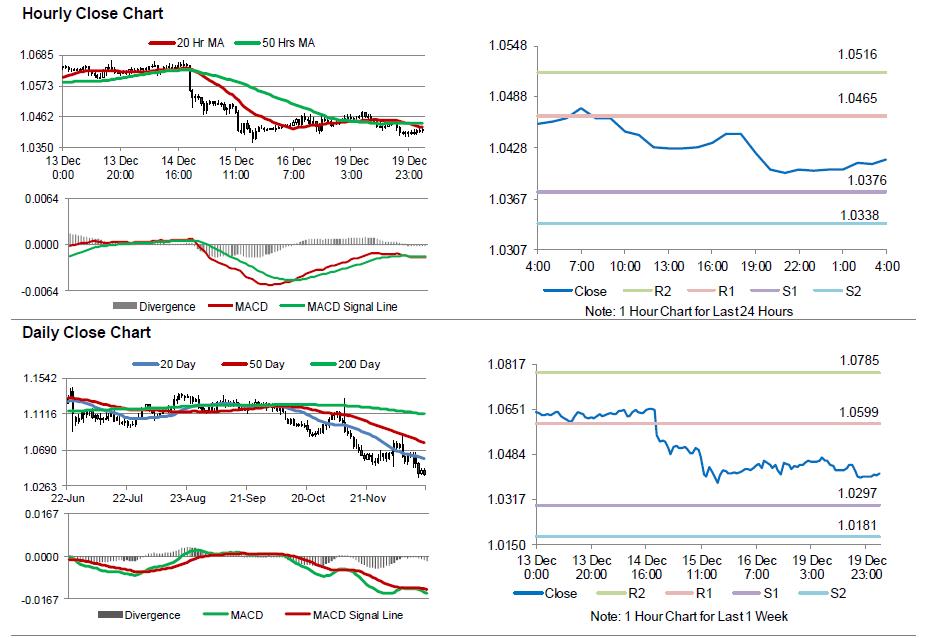

In the Asian session, at GMT0400, the pair is trading at 1.0413, with the EUR trading 0.12% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0376, and a fall through could take it to the next support level of 1.0338. The pair is expected to find its first resistance at 1.0465, and a rise through could take it to the next resistance level of 1.0516.

Going ahead, investors will closely monitor the Euro-zone’s current account for October, along with Germany’s producer price index for November, scheduled to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.