For the 24 hours to 23:00 GMT, the EUR declined 0.27% against the USD and closed at 1.1013, after Germany’s seasonally adjusted industrial production dropped more than expected by 1.8% MoM in September, suggesting Euro-zone’s biggest economy ended the third quarter on a weaker footing. Markets expected industrial production to fall by 0.5%, following a revised gain of 3.0% in the previous month. Additionally, the nation’s seasonally adjusted trade surplus unexpectedly narrowed to a level of €21.3 billion, after recording a revised trade surplus of €21.6 billion in the previous month while markets expected the nation to post a trade surplus of €23.0 billion. Moreover, the nation’s seasonally adjusted exports fell less-than-expected by 0.7% on a monthly basis in September, against a revised gain of 3.4% in the previous month whereas imports eased more-than-estimated by 0.5% MoM in September, compared to a revised rise of 1.9% in the prior month.

On the economic front, the US NFIB small business optimism index surprisingly rose to a level of 94.9 in October, notching its highest level since December 2015, while markets expected the index to remain steady at a level of 94.1, recorded in the previous month. Meanwhile, the nation’s JOLTs job openings climbed less-than-expected to a level of 5486.0K in September, compared to a revised level of 5453.0K in the prior month.

Separately, the Chicago Fed President, Charles Evans, stated that although inflation has accelerated and is close to the Federal Reserve’s 2.0% target, the central bank may not be able to reach that goal. He also added that it would be reasonable to hike interest rates in December, citing strength in the US economy.

In the Asian session, at GMT0400, the pair is trading at 1.1230, with the EUR trading 1.97% higher against the USD from yesterday’s close.

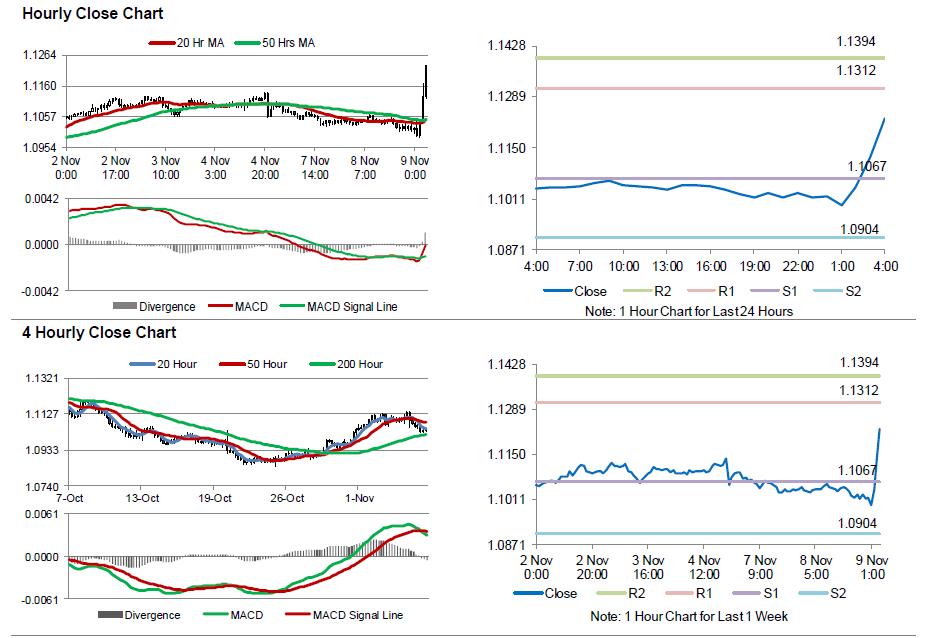

The pair is expected to find support at 1.1067, and a fall through could take it to the next support level of 1.0904. The pair is expected to find its first resistance at 1.1312, and a rise through could take it to the next resistance level of 1.1394.

Going ahead, market participants would look forward to the release of European Commission’s economic growth forecasts report, due in a few hours. Additionally, in the US, MBA mortgage applications data, scheduled to release later today, would also be keenly watched by investors.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.