For the 24 hours to 23:00 GMT, the EUR rose 0.46% against the USD and closed at 1.1196 on Friday, after Germany’s seasonally adjusted industrial production rebounded more-than-expected by 2.5% MoM in August, posting its biggest increase since January 2016, compared to market expectations for an advance of 1.0% and following a drop of 1.5% in the previous month.

Macroeconomic data released in the US indicated that the unemployment rate unexpectedly advanced to 5.0% in September, defying investor consensus for it to remain steady at 4.9%. Meanwhile, the nation’s non-farm payrolls increased by 156.0K in September, pointing towards steady growth in the labour market, after recording a revised gain of 167.0K in the previous month and falling short of market expectations for a rise by 175.0K. Moreover, the nation’s average hourly earnings inched up by 0.2% on a monthly basis in September, less than market expectations for a rise of 0.3% and following a gain of 0.1% in the prior month.

Separately, on Friday, the Federal Reserve Vice Chairman, Stanley Fischer, stated that latest jobs report was “close” to ideal, hinting that the economy is motoring ahead but not too fast to pose risks to the US economy.

In the Asian session, at GMT0300, the pair is trading at 1.1187, with the EUR trading 0.08% lower against the USD from Friday’s close.

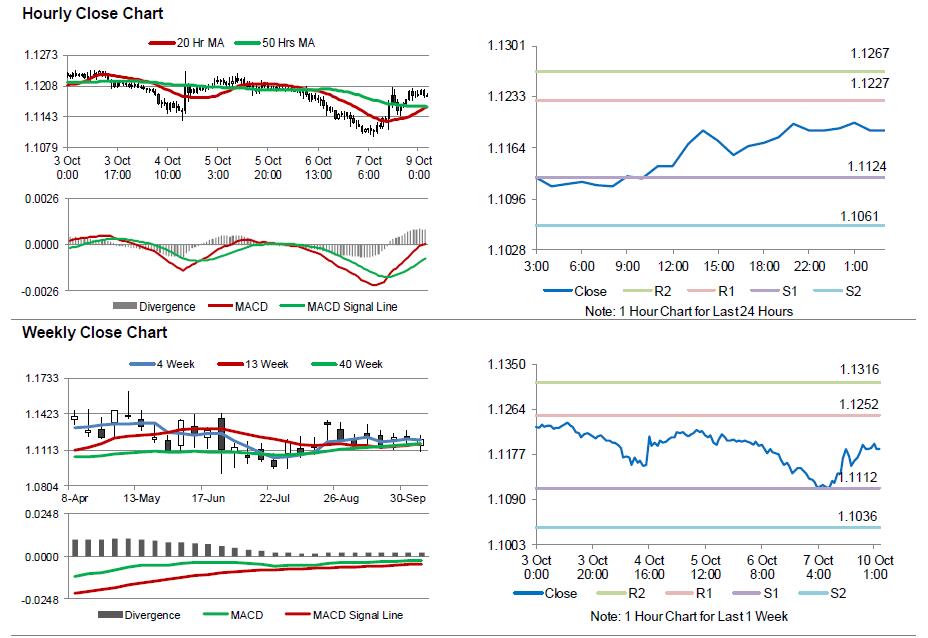

The pair is expected to find support at 1.1124, and a fall through could take it to the next support level of 1.1061. The pair is expected to find its first resistance at 1.1227, and a rise through could take it to the next resistance level of 1.1267.

Moving ahead, investors would look forward to the Euro-zone’s Sentix investor confidence for October and Germany’s trade balance for August, slated to release in a few hours.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.