For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.0539.

Macroeconomic data indicated that Germany’s seasonally adjusted industrial production rebounded more-than-expected by 2.8% on a monthly basis in January, notching its highest level in five months, suggesting that the industrial sector has returned to growth-path at the beginning of the year. Markets expected the nation’s industrial output to rise 2.7%, following a revised drop of 2.4% the prior month.

The greenback gained ground against its key counterparts, after robust ADP’s jobs data in US pointed to underlying strength in the economy that could encourage the Federal Reserve to raise interest rates next week.

Data revealed that ADP’s private sector employment advanced by 298.0K in February, posting its largest increase since December 2015 and beating market consensus for a rise of 187.0K. The private sector employment had recorded a revised gain of 261.0K in the previous month. Also, the nation’s MBA mortgage applications climbed 3.3% in the week ended 03 March 2017, following a rise of 5.8% in the previous week. On the contrary, the nation’s final wholesale inventories fell more-than-anticipated by 0.2% on a monthly basis in January, compared to an increase of 0.9% in the preceding month and following a drop of 0.1% in the preliminary print.

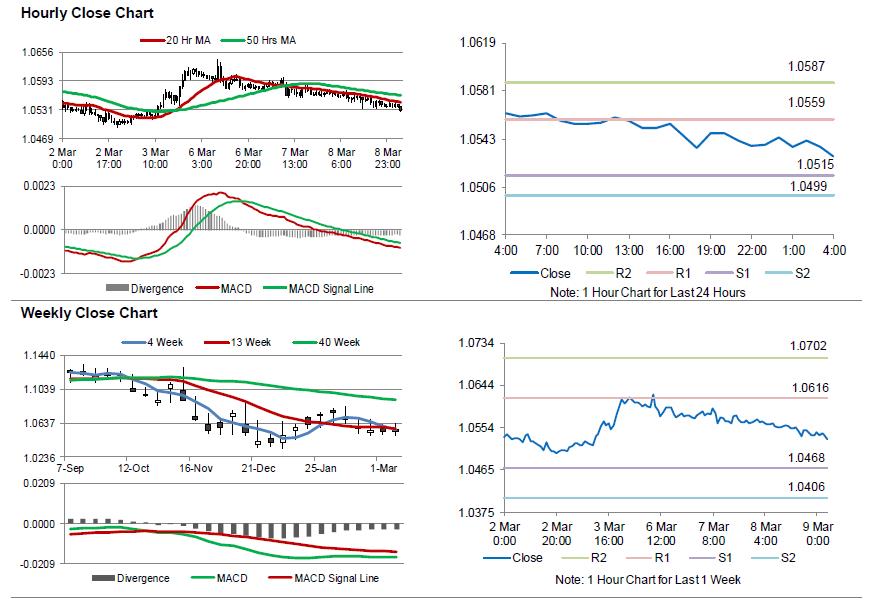

In the Asian session, at GMT0400, the pair is trading at 1.0530, with the EUR trading 0.09% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.0515, and a fall through could take it to the next support level of 1.0499. The pair is expected to find its first resistance at 1.0559, and a rise through could take it to the next resistance level of 1.0587.

Moving ahead, all eyes would be on the European Central Bank’s (ECB) interest rate decision, scheduled to be announced later in the day. Additionally, in the US, initial jobless claims data, set to release later today, will be on investor’s radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.