For the 24 hours to 23:00 GMT, the EUR declined 0.54% against the USD and closed at 1.1861, pressured by fresh worries over political turmoil in Italy.

On the macro front, data showed that Germany’s seasonally adjusted trade surplus widened more-than-anticipated to €25.2 billion in March, compared to a surplus of €18.4 billion in the previous month, while investors had envisaged for the nation’s trade surplus to widen to €22.5 billion. Moreover, the nation’s seasonally adjusted industrial production rebounded more-than-expected by 1.0% on a monthly basis in March, surging by the most in 4 months. Market participants had expected industrial production to rise 0.8%, after recording a revised drop of 1.7% in the previous month.

In the US, data revealed that JOLTs job openings climbed to a record high level of 6550.0K in March, suggesting that companies are adding workers at a robust pace in the wake of nascent economic growth in the world’s largest economy. JOLTs job openings had registered a revised reading of 6078.0K in the previous month, while markets had expected for a rise to a level of 6100.0K. Further, the nation’s NFIB small business optimism index registered an unexpected rise to a level of 104.8 in April, confounding market anticipation for a fall to a level of 104.5. In the prior month, the index had registered a level of 104.7.

In the Asian session, at GMT0300, the pair is trading at 1.1852, with the EUR trading 0.08% lower against the USD from yesterday’s close.

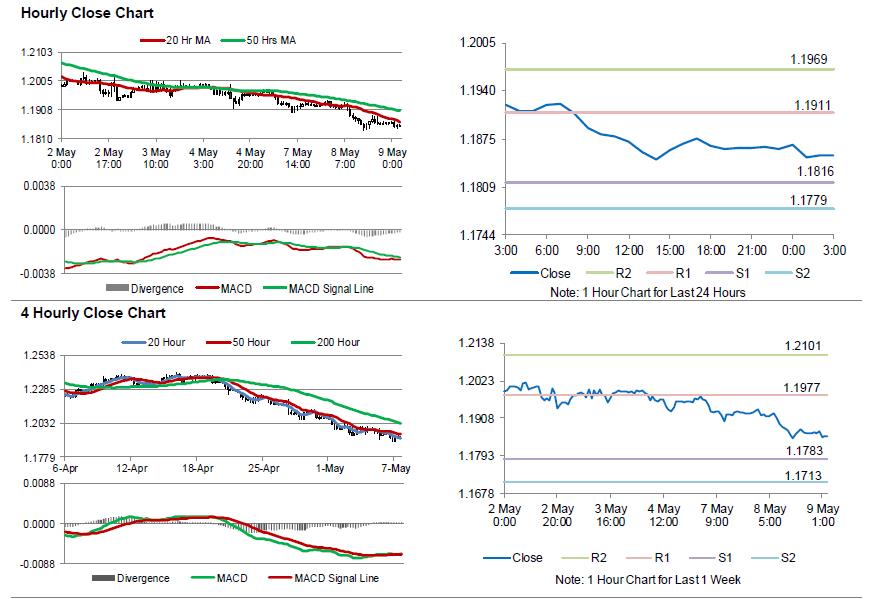

The pair is expected to find support at 1.1816, and a fall through could take it to the next support level of 1.1779. The pair is expected to find its first resistance at 1.1911, and a rise through could take it to the next resistance level of 1.1969.

With no key macroeconomic releases in the Euro-zone today, investors would direct their attention to the US producer price index for April and MBA mortgage applications, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.