For the 24 hours to 23:00 GMT, the EUR declined 0.71% against the USD and closed at 1.1138.

On the economic front, the Euro-zone’s ZEW economic sentiment index advanced more than expected to a level of 12.3 in October, indicating that investors remain increasingly optimistic about the region’s economic outlook. Meanwhile, markets expected the index to advance to a level of 6.3 and following a level of 5.4 in the prior month.

Additionally, Germany’s ZEW survey of economic sentiment index advanced to a level of 6.2 in October, notching its highest level since June 2016, compared to a level of 0.5 in the previous month and beating investor consensus for a rise to a level of 4.0. Moreover, the nation’s current situation index advanced to a level of 59.5 in October, after recording a level of 55.1 in the prior month.

In the US, data indicated that, the NFIB small business optimism index unexpectedly eased to a level of 94.1 in September, defying market expectations for it to rise to a level of 95.0 and following a level of 94.4 in the preceding month. On the contrary, the nation’s labour market conditions index surprisingly declined to a level of 2.2 in September, after recording a revised reading of -1.3 in the previous month.

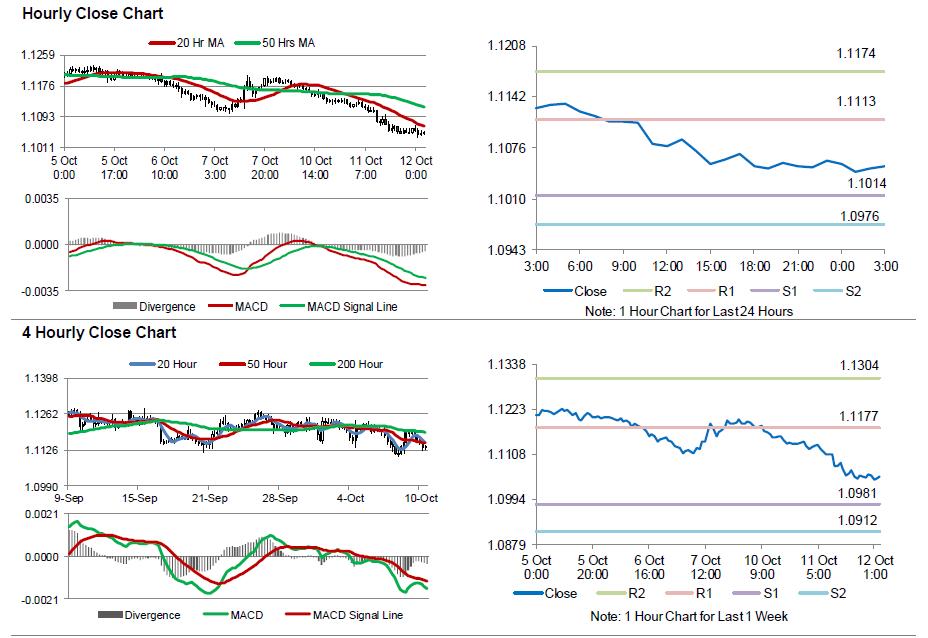

In the Asian session, at GMT0300, the pair is trading at 1.1051, with the EUR trading 0.07% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1014, and a fall through could take it to the next support level of 1.0976. The pair is expected to find its first resistance at 1.1113, and a rise through could take it to the next resistance level of 1.1174.

Going ahead, market participants will look forward to the Euro-zone’s industrial production data for August, scheduled to release in a few hours. Moreover, in the US, the FOMC meeting minutes, due to release later today, would pique a lot of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.