For the 24 hours to 23:00 GMT, the EUR rose 0.27% against the USD and closed at 1.1873.

On the macro front, the Euro-zone’s seasonally adjusted current account surplus narrowed to €30.8 billion in October, after recording a revised surplus of €39.2 billion in the prior month.

Separately, Germany’s producer price index (PPI) climbed less-than-anticipated by 2.5% on an annual basis in November, rising at its weakest pace in four months. The PPI had recorded a gain of 2.7% in the previous month, while markets were expecting for an advance of 2.6%.

In the US, data showed that existing home sales climbed 5.6% on a monthly basis to a level of 5.81 million in November, notching its highest level since December 2006, thus suggesting that the nation’s housing sector is on a stable path to recovery. Existing home sales had registered a revised reading of 5.50 million in the prior month, while investors had envisaged for a rise to a level of 5.53 million. On the other hand, the nation’s MBA mortgage applications recorded a drop of 4.9% in the week ended 15 December 2017, compared to a fall of 2.3% in the prior week.

Meanwhile, the US House of Representatives, voting for the second time, approved a revised Republican tax bill, passing the country’s biggest tax overhaul in three decades.

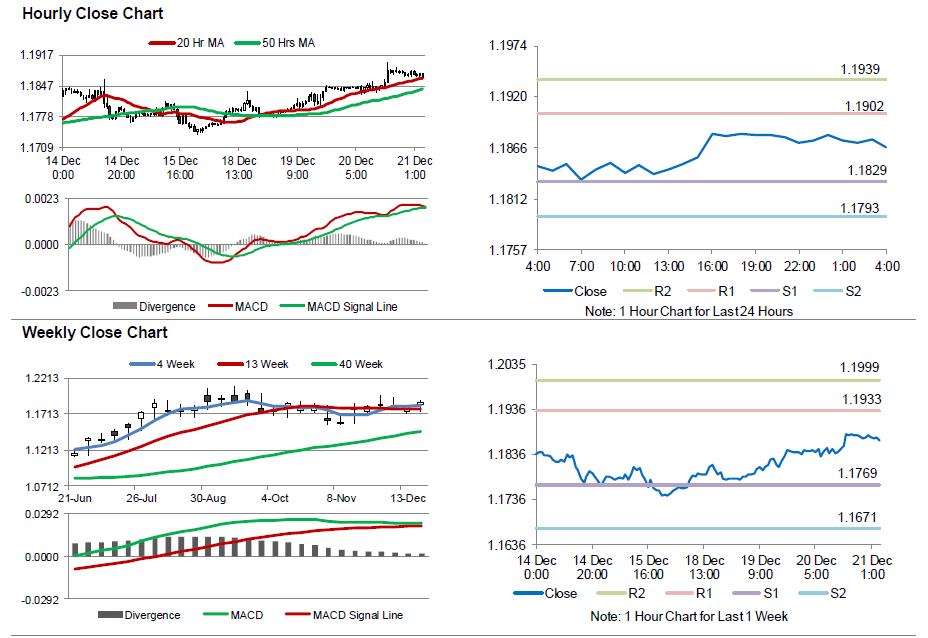

In the Asian session, at GMT0400, the pair is trading at 1.1866, with the EUR trading 0.06% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1829, and a fall through could take it to the next support level of 1.1793. The pair is expected to find its first resistance at 1.1902, and a rise through could take it to the next resistance level of 1.1939.

Moving ahead, traders would look forward to the Euro-zone’s flash consumer confidence index for December, scheduled to release later in the day. Moreover, the US 3Q GDP and initial jobless claims data, set to release later today, will keep investors’ on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.