For the 24 hours to 23:00 GMT, the EUR declined 0.11% against the USD and closed at 1.0390.

In economic news, data indicated that the Euro-zone’s seasonally adjusted current account surplus widened to €28.4 billion in October, following a revised surplus of €27.7 billion in the previous month.

Additionally, Germany’s producer price index unexpectedly rebounded for the first time in three years, after it gained 0.1% on an annual basis in November, confounding market expectations for a fall of 0.2% and after recording a drop of 0.4% in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0408, with the EUR trading 0.17% higher against the USD from yesterday’s close.

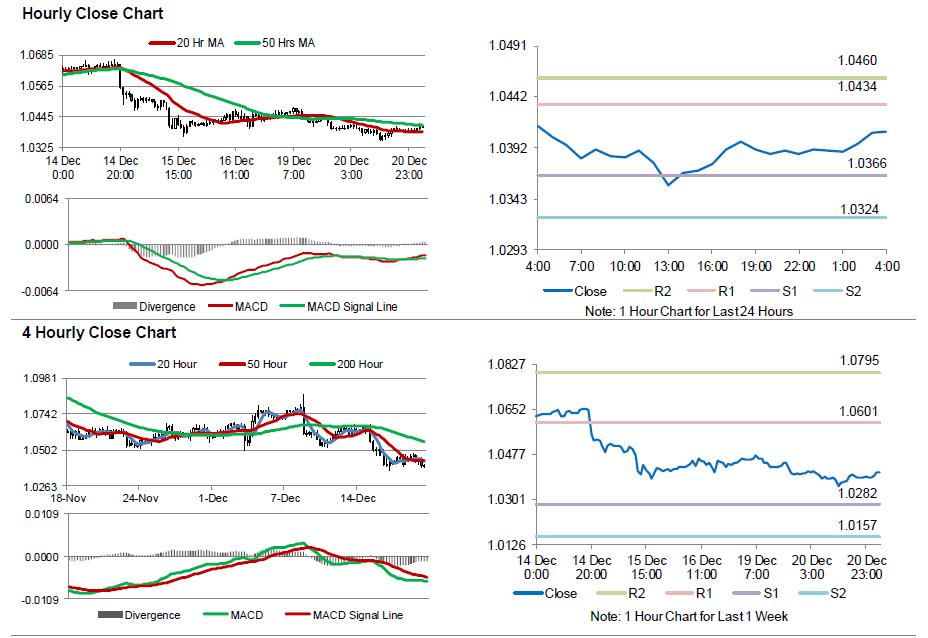

The pair is expected to find support at 1.0366, and a fall through could take it to the next support level of 1.0324. The pair is expected to find its first resistance at 1.0434, and a rise through could take it to the next resistance level of 1.0460.

Moving ahead, investors will look forward to the Euro-zone’s preliminary consumer confidence index for December, scheduled to release later today. Moreover, in the US, existing home sales for November and weekly mortgage applications data, due to release later in the day, will attract a lot of market attention.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.