For the 24 hours to 23:00 GMT, the EUR declined marginally against the USD and closed at 1.1201, after the Euro-zone’s final Markit services PMI eased to a level of 52.2 in September, compared to a level of 52.8 in the previous month while the preliminary figures had indicated a fall to a level of 52.1. Further, the region’s retail sales fell less-than-expected by 0.1% MoM in August, against a revised gain of 0.3% in the previous month whereas markets had envisaged for a drop of 0.3%.

Elsewhere, in Germany, the final Markit services PMI eased to a level of 50.9 in September, expanding at the slowest pace in more than three years. The PMI registered a reading of 51.7 in the prior month while markets anticipated the index to remain steady at a preliminary print of 50.6.

In the US, the ISM non-manufacturing PMI advanced to a level of 57.1 in September, hitting its highest level in eleven-months, thus indicating that the economy is growing at a steady pace. Markets expected the index to climb to a level of 53.0, following a reading of 51.4 in the previous month. Moreover, the nation’s factory orders surprisingly gained by 0.2% in August, adding to sign that the manufacturing sector is regaining some steam. Factory orders recorded a revised increase of 1.4% in the prior month, compared to market expectations for a drop of 0.2%. Also, the nation’s final durable goods orders climbed by 0.1% in August while markets expected it to record a flat reading and after recording a revised rise of 3.6% in the prior month. On the contrary, US ADP employment indicated that private sector added 154.0K jobs in September, adding the lowest jobs since April 2016, compared to a level of 177.0K in the preceding month and falling short of investor consensus for a rise to a level of 165.0K. Additionally, the nation’s trade deficit unexpectedly widened to a level of $40.7 billion in August, as a rise in imports weighed on higher exports. The nation posted a trade deficit of $39.5 billion in the preceding month.

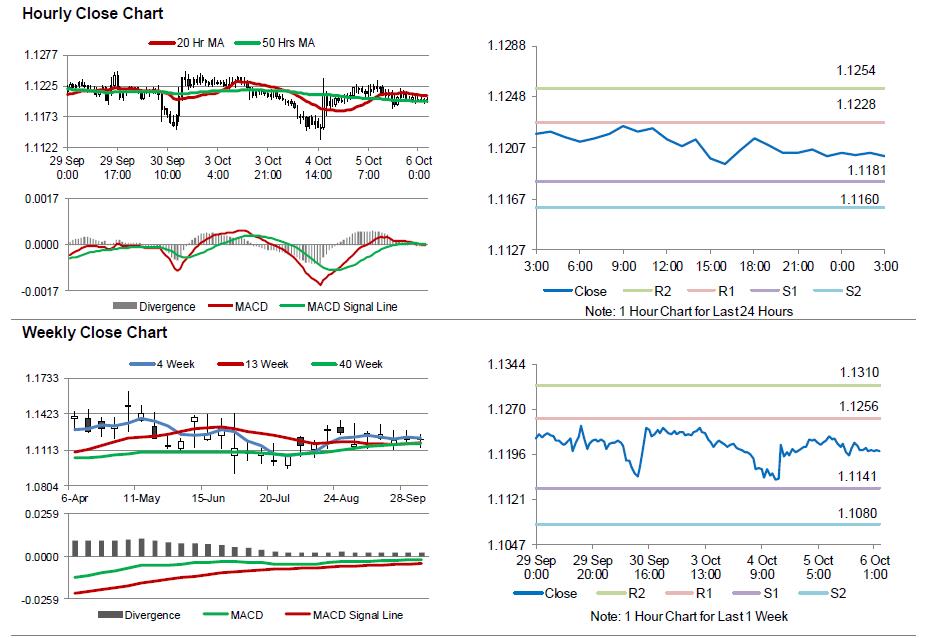

In the Asian session, at GMT0300, the pair is trading at 1.1201, with the EUR trading flat against the USD from yesterday’s close.

The pair is expected to find support at 1.1181, and a fall through could take it to the next support level of 1.1160. The pair is expected to find its first resistance at 1.1228, and a rise through could take it to the next resistance level of 1.1254.

Going ahead, investors would closely monitor Germany’s factory orders for August and construction PMI for September, scheduled to release in a few hours. Additionally, the ECB’s monetary policy meeting accounts, due later in the day, would be closely watched by investors. Moreover, the US initial jobless claims data, slated to release later today, would attract a lot of investor attention.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.