For the 24 hours to 23:00 GMT, the EUR declined 0.35% against the USD and closed at 1.1829, after Eurozone’s retail sales unexpectedly dropped in October and a final reading on Germany’s Markit services PMI showed an unexpected drop in November.

Data showed that Eurozone’s seasonally adjusted retail sales slid more-than-anticipated by 1.1% MoM in October, compared to a revised advance of 0.8% in the previous month. Market expectation was for retail sales to fall 0.7%. Additionally, activity in Germany’s services sector unexpectedly slowed to a three-month low level of 54.3 in November, while the preliminary figures had indicated an advance to a level of 54.9. In the previous month, the PMI had registered a level of 54.7.

Meanwhile, the Euro-zone’s final Markit services PMI climbed to a six-month high level of 56.2 in November, confirming the preliminary print. The PMI had registered a reading of 55.0 in the previous month.

Macroeconomic data releases in the US indicated that the ISM non-manufacturing PMI declined more-than-expected to a level of 57.4 in November, amid a notable slowdown in new orders. Market participants had envisaged the PMI to drop to a level of 59.0, compared to a level of 60.1 in the prior month. Moreover, the nation’s final Markit services PMI dropped more than initially estimated to a level of 54.5 in November, compared to a level of 55.3 in the prior month. Meanwhile, the preliminary figures had recorded a drop to a level of 54.7.

Other data revealed that trade deficit in the US widened more-than-anticipated to $48.7 billion in October, hitting a nine-month high level, amid a surge in imports, thus suggesting that trade could act as a drag on the nation’s fourth quarter growth. The nation had reported a revised trade deficit of $44.9 billion in the previous month, while market participants had expected for deficit of $47.5 billion.

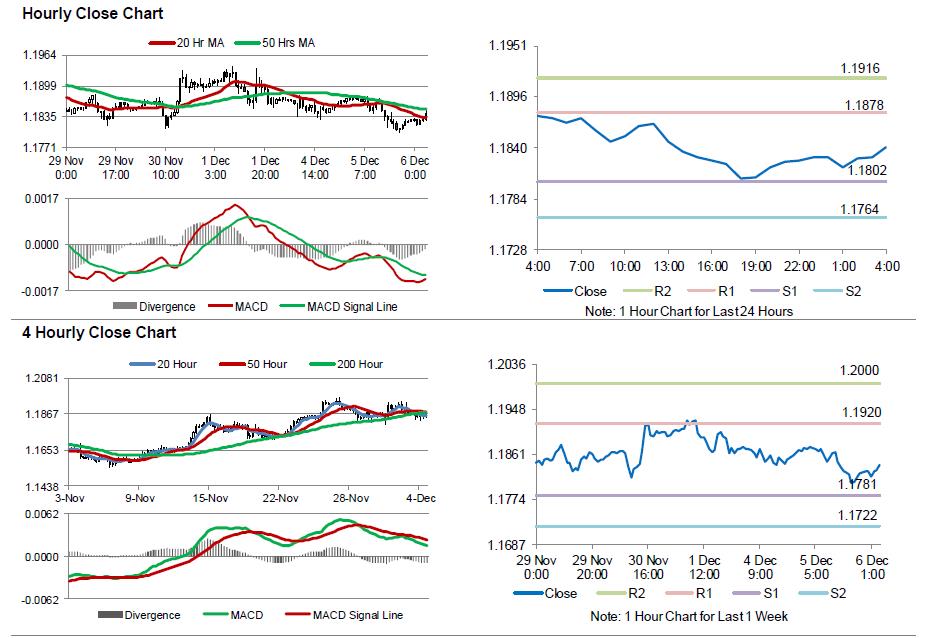

In the Asian session, at GMT0400, the pair is trading at 1.1841, with the EUR trading 0.1% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1802, and a fall through could take it to the next support level of 1.1764. The pair is expected to find its first resistance at 1.1878, and a rise through could take it to the next resistance level of 1.1916.

Going ahead, traders would keep a close watch on Germany’s factory orders for October, followed by Markit construction PMI for November, both due to release in a few hours. Moreover, in the US, the APD employment change data for November, slated to release later in the day, will garner significant amount of investor attraction.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.