For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.0652.

On the economic data front, Germany’s seasonally adjusted trade surplus narrowed more-than-expected to a level of €18.7 billion in December, following a revised trade surplus of €22.7 billion in the previous month, while markets were expecting the nation to post a surplus of €20.5 billion. Moreover, the nation’s exports dropped more-than-anticipated by 3.3% on a monthly basis in December, compared to a rise of 3.9% in the previous month. Meanwhile, imports surprisingly remained flat in December, after recording a gain of 3.5% in the prior month.

The greenback gained ground against most of its peers, propelled by comments from the US President, Donald Trump, that he would make a major announcement on a “phenomenal” tax plan in the next few weeks.

Gains in the greenback were boosted further, after data indicated that first-time claims for US unemployment benefits unexpectedly fell to a three-month low level of 234.0K in the week ended 04 February, thus painting a healthy picture of the nation’s labour market. Initial jobless claims had recorded a level of 246.0K in the prior week, while investors had envisaged for a rise to a level of 249.0K. Also, the nation’s final wholesale inventories advanced 1.0% on a monthly basis in December, in line with preliminary estimates and following a similar rise in the prior month.

Meanwhile, the Federal Reserve (Fed) Bank of St. Louis President, James Bullard, stated that interest rates can likely remain low through at least 2017, because uncertainty over the fiscal policies of the Trump administration clouds the US economic outlook. He further added that he favours only one interest rate hike for this year and wouldn’t speculate on when it might occur. Separately, the Chicago Fed President, Charles Evans, reiterated his support for gradual interest rate hikes and stated that the Fed is likely to raise interest rates three times this year as he expects an economic boost from the US President, Donald Trump’s planned fiscal policies.

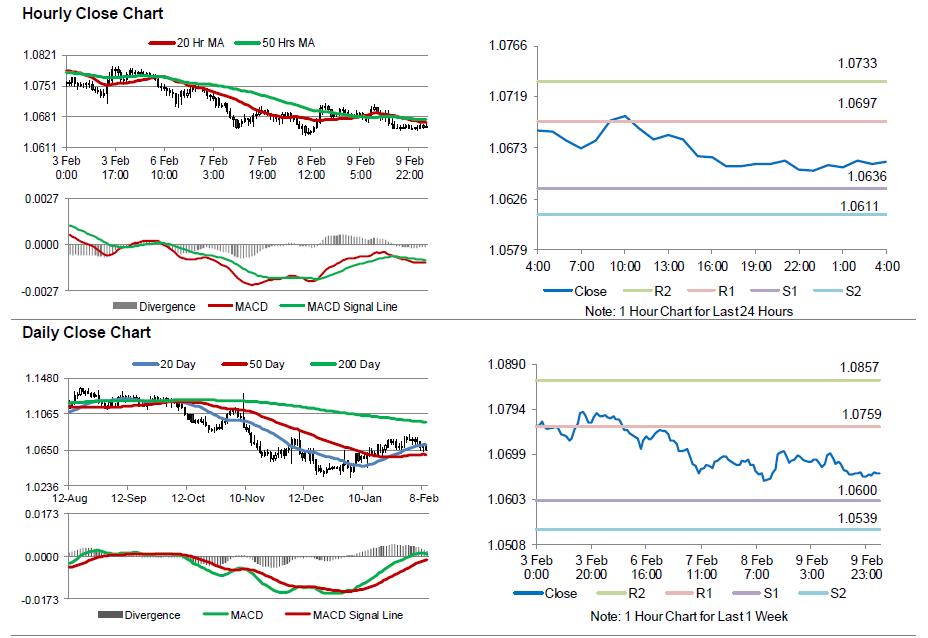

In the Asian session, at GMT0400, the pair is trading at 1.0660, with the EUR trading 0.08% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0636, and a fall through could take it to the next support level of 1.0611. The pair is expected to find its first resistance at 1.0697, and a rise through could take it to the next resistance level of 1.0733.

Amid a lack of major economic releases in the Euro-zone toady, investors would keep a close watch on the US flash Michigan consumer confidence index for February, scheduled to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.