For the 24 hours to 23:00 GMT, the EUR rose 0.08% against the USD and closed at 1.2032 on Friday.

In economic news, Germany’s seasonally adjusted trade surplus narrowed more-than-expected to a level of €19.5 billion in July, as growth in imports outstripped that of exports. The nation had registered a trade surplus of €22.3 billion in the prior month, while market participants were expecting the country’s surplus to narrow to a level of €21.0 billion.

In the US, data indicated that consumer credit increased more-than-expected by $18.5 billion in July, after rising by a revised $11.8 billion in June and compared to market expectations for a rise of $15.0 billion. Further, the nation’s seasonally adjusted final wholesale inventories grew more than initially estimated by 0.6% in July, compared to a flash print indicating a rise of 0.4%. Wholesale inventories had registered a revised similar rise in the previous month.

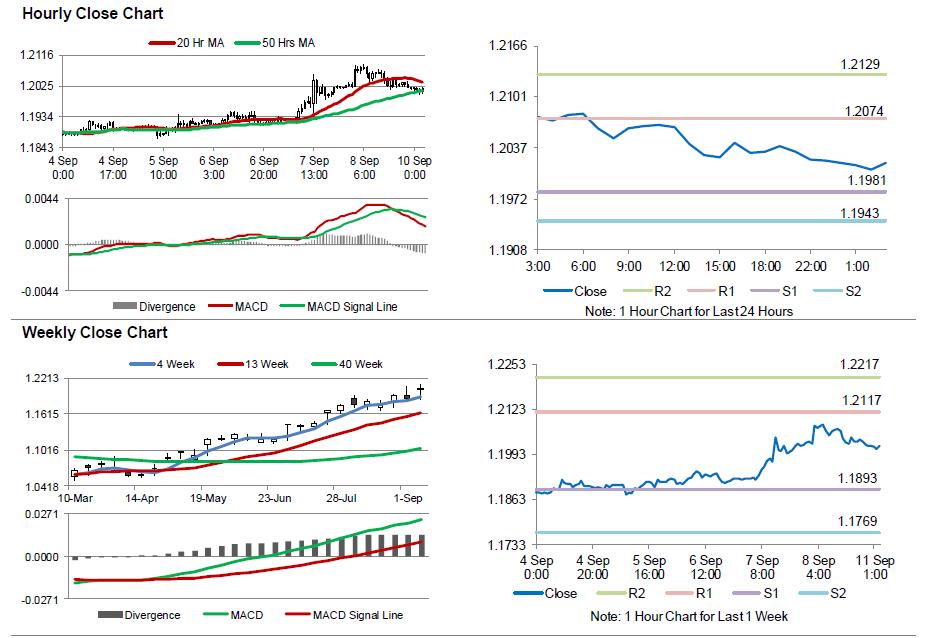

In the Asian session, at GMT0300, the pair is trading at 1.2018, with the EUR trading 0.12% lower against the USD from Friday’s close.

The pair is expected to find support at 1.1981, and a fall through could take it to the next support level of 1.1943. The pair is expected to find its first resistance at 1.2074, and a rise through could take it to the next resistance level of 1.2129.

With no macroeconomic releases in the Euro-zone today, investor sentiment will be governed by global macroeconomic factors.

The currency pair is trading below its 20 Hr moving average and showing convergence with its 50 Hr moving average.