For the 24 hours to 23:00 GMT, the EUR declined 0.57% against the USD and closed at 1.0553 on Friday, after Germany’s seasonally adjusted trade surplus narrowed more-than-expected to €19.3 billion in October, compared to market expectations for the nation to post a trade surplus of €22.0 billion and following a revised trade surplus of €24.2 billion in the prior month.

The greenback gained ground against most of its major peers, after the US flash Reuters/Michigan consumer confidence index surged more-than-expected to a level of 98.0 in December, notching its highest level since January 2015, thus indicating that Americans are getting increasingly optimistic about the nation’s growth prospects. The index recorded a level of 93.8 in the previous month, while market expected the index to climb to a level of 94.5. On the other hand, the nation’s final wholesale inventories dropped 0.4% in October, meeting the preliminary print and compared to a revised fall of 0.1% in the prior month.

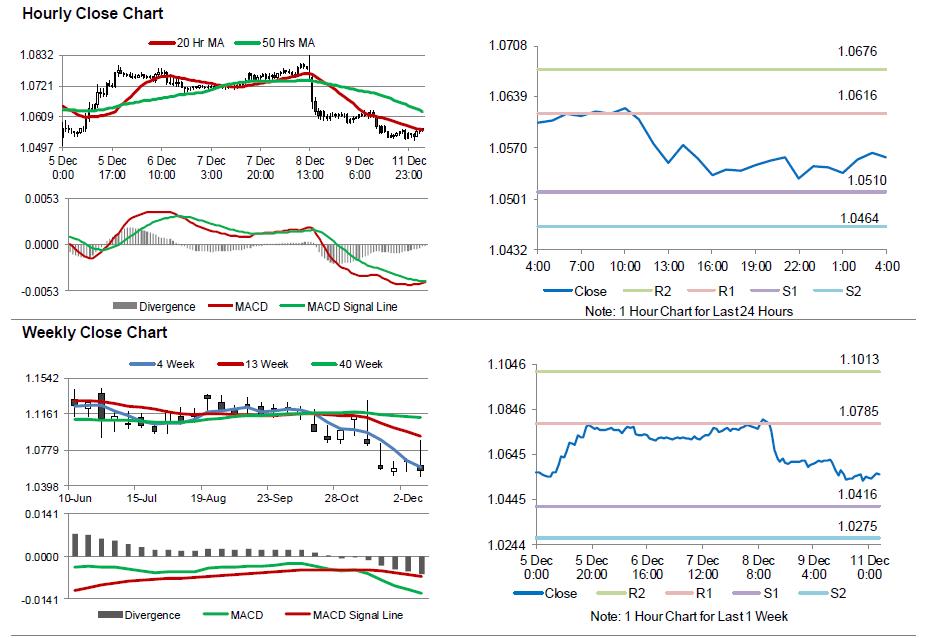

In the Asian session, at GMT0400, the pair is trading at 1.0557, with the EUR trading marginally higher against the USD from Friday’s close.

The pair is expected to find support at 1.0510, and a fall through could take it to the next support level of 1.0464. The pair is expected to find its first resistance at 1.0616, and a rise through could take it to the next resistance level of 1.0676.

With no economic releases in the Euro-zone today, investors will look forward to the US monthly budget statement, slated to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.