For the 24 hours to 23:00 GMT, the EUR declined 0.05% against the USD and closed at 1.3524, as the risk appetite among investors continued to remain strained as the ongoing tensions in the Ukraine-Russia conflict worsened after the US intensified its charges on Russia’s involvement in the downing of a Malaysian airliner on the Russia-Ukraine border. Meanwhile, the common currency further suffered losses after the Bundesbank in its monthly report revealed that the Euro-zone’s largest economy, Germany’s economic growth has deteriorated, in the wake of geopolitical concerns from the Ukraine crisis and Israel’s ground offensive in Gaza. However, the IMF issued an upbeat outlook on German economy and upgraded its growth forecast to 1.9%, as compared to previous forecast of 1.7%. Furthermore, the fund warned that any escalation in the tensions between the West and Moscow could have a significant impact on Germany as it has strong trade ties with Russian companies.

On the economic front, the producer price index in Germany remained flat, on a monthly basis in June, as compared to a 0.2% decline in the previous month. Separately, the seasonally adjusted industrial orders of Italy recorded a drop of 2.1%, on a monthly basis in May, from a 3.6% gain in the previous month.

In the US, data released indicated that Chicago Fed’s national activity index unexpectedly dropped to 0.12 in the US, compared to a revised reading of 0.16 in the prior month.

In the Asian session, at GMT0300, the pair is trading at 1.3525, with the EUR trading tad higher from yesterday’s close.

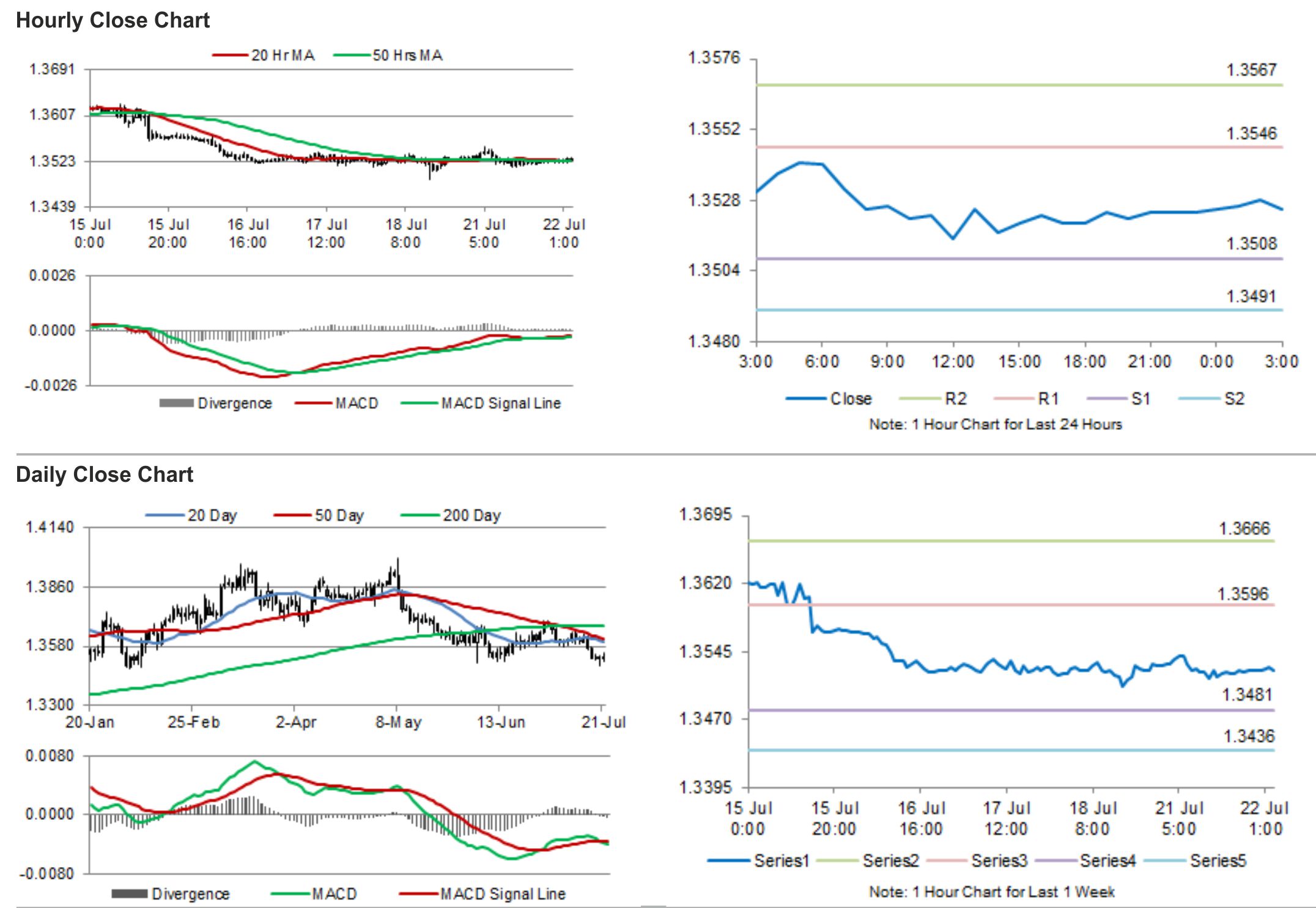

The pair is expected to find support at 1.3508, and a fall through could take it to the next support level of 1.3491. The pair is expected to find its first resistance at 1.3546, and a rise through could take it to the next resistance level of 1.3567.

Investors would keenly wait for the crucial inflation numbers from the US, to be released later during the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.