For the 24 hours to 23:00 GMT, the EUR rose 0.36% against the USD and closed at 1.1052, after Germany’s final consumer price index (CPI) climbed by 0.1% on a monthly basis in September, in line with market expectations and confirming the preliminary estimate. In the previous month, the CPI had recorded a flat reading. Meanwhile, the nation’s annual CPI accelerated to a 16-month high level, after it rose by 0.7% in September, compared to an advance of 0.4% in the prior month. The preliminary figures had also indicated an advance of 0.7%.

In the US, data revealed that initial jobless claims remained flat at a 43-year low level of 246.0K in the last week, pointing towards a steady labour market that could pave the way for a Fed interest rate hike in December. Meanwhile, market anticipations were for initial jobless claims to advance to a level of 253.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1045, with the EUR trading 0.06% lower against the USD from yesterday’s close.

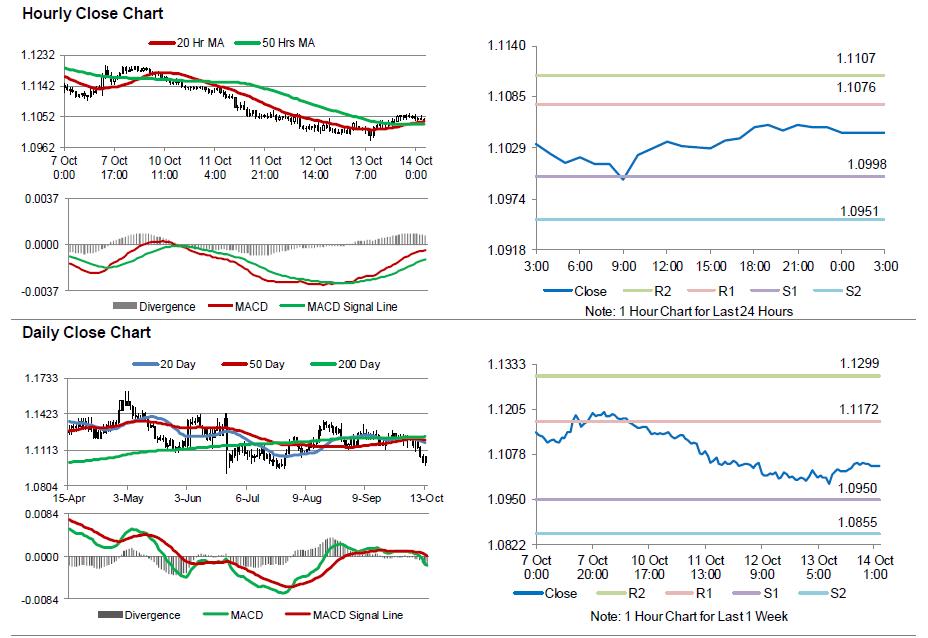

The pair is expected to find support at 1.0998, and a fall through could take it to the next support level of 1.0951. The pair is expected to find its first resistance at 1.1076, and a rise through could take it to the next resistance level of 1.1107.

Going ahead, market participants await the release of Euro-zone’s trade balance figures for August, slated to release in a few hours. Additionally, investors would also concentrate on a speech by the US Fed Chairwoman, Janet Yellen, along with the US flash Reuters/Michigan consumer sentiment index for October and advance retail sales for September, due to release later in the day.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.