For the 24 hours to 23:00 GMT, the EUR declined 0.83% against the USD and closed at 1.0928, after downbeat economic data across the Euro-zone.

Data indicated that, the Eurozone’s final consumer confidence index eased to -8.8 in February, compared to a similar preliminary reading. Additionally, the region’s economic confidence index fell more-than-expected to a level of 103.8 in February, after recording a revised reading of 105.1 in the previous month and compared to market expectations for a fall to a level of 104.4. Further, the region’s business climate indicator fell to a level of 0.07 in February, compared to a level of 0.29 in the previous month. Markets were expecting it to drop to a level of 0.27.

Another set of economic data showed that Germany’s flash consumer price index rose less-than-anticipated by 0.4% MoM in February while markets expected it to advance by 0.5%, after recording a drop of 0.8% in the previous month. Meanwhile, the nation’s annual preliminary inflation recorded a flat reading in February, thus increasing pressure on the ECB to take strong aggressive policy actions at its meeting in March.

The greenback gained ground, after the second estimate of US Q4 GDP rose more-than-expected by 1.0% in 4Q 2015, compared to preliminary print of an advance of 0.8%, indicating that a Fed rate hike is still on the cards. Moreover, the nation’s final Reuters/Michigan consumer sentiment index advanced more-than-anticipated to a level of 91.7 in February, compared to a preliminary reading of 90.7, whereas markets anticipated for a rise to a level of 91.0. Also, the nation’s consumer spending rose at the fastest pace in ten-months by 0.5% in January, after recording a revised gain of 0.1% in the preceding month and compared to investor expectations for a gain of 0.3%.

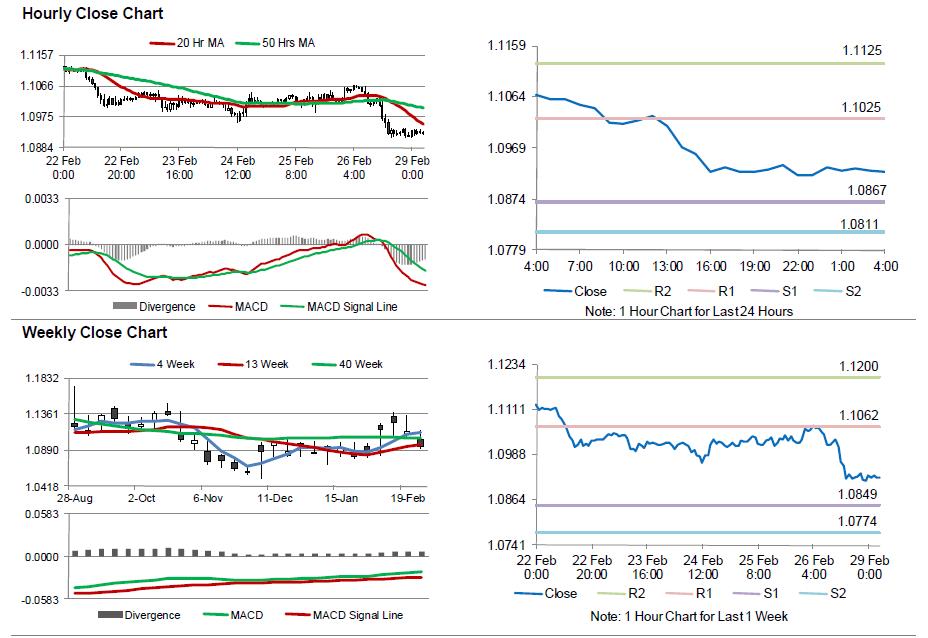

In the Asian session, at GMT0400, the pair is trading at 1.0924, with the EUR trading marginally higher from Friday’s close.

The pair is expected to find support at 1.0867, and a fall through could take it to the next support level of 1.0811. The pair is expected to find its first resistance at 1.1025, and a rise through could take it to the next resistance level of 1.1125.

Moving ahead, investors will look forward to Euro-zone’s annual consumer price index and Germany’s retail sales data, slated to be released in a few hours. Additionally, US pending home sales data, scheduled to be released later today, will also attract market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.