For the 24 hours to 23:00 GMT, the EUR rose 0.82% against the USD and closed at 1.0982 on Friday, after Germany’s inflation data notched a two-year high in October, suggesting that the European Central Bank’s massive stimulus measures were working in warding off deflation threats in Euro-zone’s largest economy. Additionally, on a monthly basis, the preliminary CPI rose by 0.2% in October, meeting market expectations and following a rise of 0.1% in the previous month.

Separately, the Euro-zone’s final consumer confidence index improved to a level of -8.0 in October, in line with market expectations and confirming the preliminary print.

In the US, the flash annualised gross domestic product (GDP) expanded more-than-expected at the fastest pace in two years, after it rose by 2.9% on a quarterly basis in 3Q 2016, aided by a surge in exports, thus reinforcing expectations that the US Fed may push ahead with an interest rate hike at the December policy meeting. The economy grew by 1.4% in the prior quarter while markets expected for an advance of 2.6%. On the other hand, the nation’s final Reuters/Michigan consumer sentiment index eased to a level of 87.2 in October, amid growing uncertainty about the economy ahead of the upcoming Presidential election. The index registered a drop of 87.9 in the preliminary print, after recording a reading of 91.2 in the previous month.

In the Asian session, at GMT0400, the pair is trading at 1.0968, with the EUR trading 0.13% lower against the USD from Friday’s close.

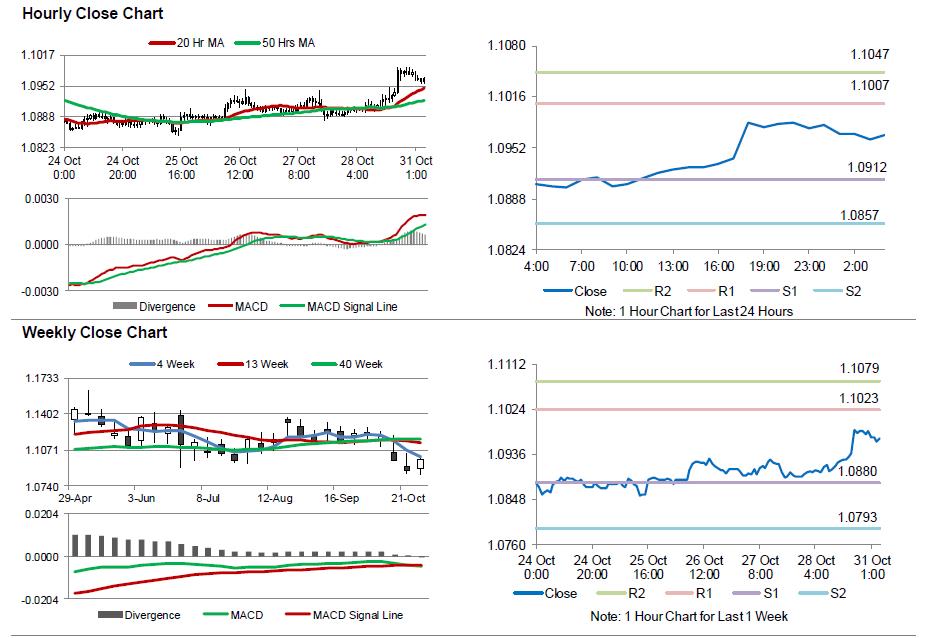

The pair is expected to find support at 1.0912, and a fall through could take it to the next support level of 1.0857. The pair is expected to find its first resistance at 1.1007, and a rise through could take it to the next resistance level of 1.1047.

Moving ahead, investors would concentrate on Germany’s retail sales for September, due in some time along with the Euro-zone’s flash GDP for 3Q and preliminary consumer price index for October, slated to release in a few hours. Moreover, the US personal income and spending for September, scheduled to release later today, would garner market attention.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.