For the 24 hours to 23:00 GMT, the EUR declined 0.77% against the USD and closed at 1.2236, after Germany’s annual inflation growth missed market expectations in February.

Data revealed that Germany’s flash consumer price index (CPI) registered a rise of 1.4% on an annual basis in February, falling short of market expectations for a gain of 1.5%, thus suggesting that persistently sluggish inflation readings will weigh on the European Central Bank’s (ECB) decision to pare back its extraordinary stimulus anytime soon. The CPI had recorded an advance of 1.6% in the previous month.

Separately, the Euro-zone’s final consumer confidence index eased to a level of 0.1 in February, confirming the preliminary print. In the previous month, the index had registered a revised level of 1.4.

Other data showed that the region’s economic sentiment indicator dropped to a 3-month low level of 114.1 in February, compared to market consensus for a fall to a level of 114.0. In the prior month, the index had registered a revised reading of 114.9. Additionally, the region’s business climate indicator fell to a level of 1.48 in February, hitting its lowest level since October 2017. The index had registered a revised level of 1.56 in the prior month, while markets were expecting it to ease to a level of 1.47.

The US Dollar advanced against its major peers, after the Federal Reserve Chair, Jerome Powell, conveyed an upbeat picture of the US economy and signalled that the Fed remains on course for gradual interest rate hikes.

The new Fed Chairman, in a testimony before Congress, noted that the US economic outlook had brightened in the past few months, on the back of stronger economic fundamentals and the passage of a $1.5 trillion tax cut plan. Further, he pledged to “strike a balance” between the risk of an overheating economy while sticking with a plan to gradually raise short-term interest rates as recent data has strengthened prospects of higher inflation. Commenting on the latest stock market rout, Powell stated that these developments would not weigh heavily on the US economy.

On the macro front, the preliminary durable goods orders in the US slid 3.7% on a monthly basis in January, dropping by the most in 6 months and higher than market expectations for a fall of 2.0%. In the previous month, durable goods orders had climbed 2.8%. Further, the nation’s advance goods trade deficit surprisingly widened to $74.4 billion in January, while investors had envisaged the nation’s advance goods trade deficit to remain steady at a revised level of $72.3 billion registered in the prior month.

On the other hand, the US CB consumer confidence index jumped more-than-estimated to a level of 130.8 in February, surging to a 17-year high level, as optimism over employment prospects improved. Market participants had anticipated the index to rise to a level of 126.5, after recording a revised reading of 124.3 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.2224, with the EUR trading 0.1% lower against the USD from yesterday’s close.

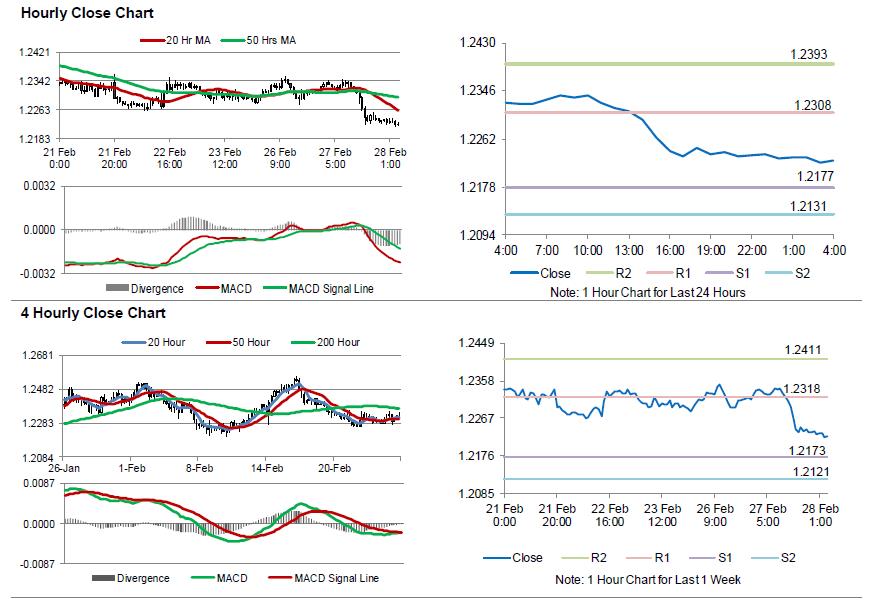

The pair is expected to find support at 1.2177, and a fall through could take it to the next support level of 1.2131. The pair is expected to find its first resistance at 1.2308, and a rise through could take it to the next resistance level of 1.2393.

Going ahead, traders would focus on the Euro-zone’s flash inflation numbers for February as well as Germany’s GfK consumer confidence index for March and unemployment rate data for February, all slated to release in a few hours. Moreover, the second estimate of the US 4Q GDP and pending home sales data for January, will pique significant amount of market attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.