For the 24 hours to 23:00 GMT, the EUR declined 0.3% against the USD and closed at 1.0699.

Macroeconomic data indicated that Germany’s preliminary consumer price index (CPI) jumped 1.9% on an annual basis in January, accelerating at its fastest pace in more than three-years, thus providing further evidence to the European Central Bank (ECB) that its loose monetary policy is working. The CPI recorded an advance of 1.7% in the previous month, while markets were expecting for a rise of 2.0%.

Additionally, the Euro-zone’s final consumer confidence index was revised up to a level of -4.7 in January, compared to market consensus for the index to remain steady at a level of -4.9, recorded in the preliminary print. In the prior month, the index had registered a level of -5.1. Moreover, the region’s economic sentiment indicator unexpectedly advanced to a level of 108.2 in January, hitting its highest level in six-years, highlighting that businesses and consumers across the Euro-bloc are growing confident about the region’s growth prospects. In the preceding month, the index registered a reading of 107.8, while investors had envisaged for a steady reading. Also, the region’s industrial confidence index increased to a level of 0.8 in January, notching its highest level since June 2011, compared to a revised flat reading in the prior month.

In the US, data revealed that pending home sales rebounded 1.6% MoM in December, surpassing market expectations for a rise of 1.0% and following a drop of 2.5% in the previous month. Further, the nation’s personal spending climbed 0.5% in December, in line with market expectations and recording its biggest increase in three months. Personal spending registered a gain of 0.2% in the prior month. Meanwhile, the US personal income advanced less-than-expected by 0.3% in December, compared to a revised rise of 0.1% in the prior month, whereas markets were anticipating personal income to rise 0.4%. Moreover, the Dallas Fed manufacturing business index unexpectedly climbed to a level of 22.1 in January, compared to market expectations of a fall to a level of 15.0. In the previous month, the index had registered a revised reading of 17.7.

In the Asian session, at GMT0400, the pair is trading at 1.0697, with the EUR trading marginally lower against the USD from yesterday’s close.

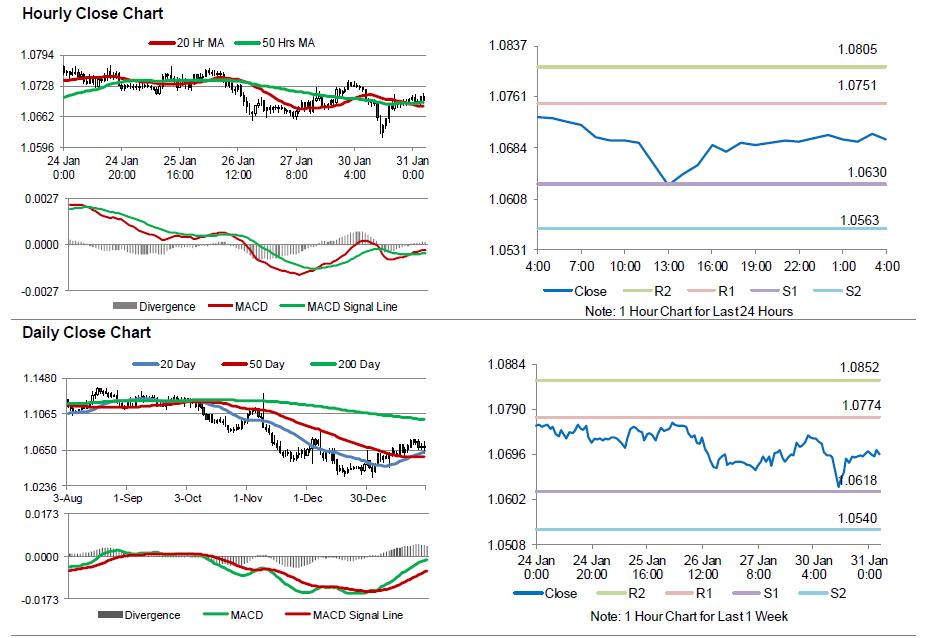

The pair is expected to find support at 1.0630, and a fall through could take it to the next support level of 1.0563. The pair is expected to find its first resistance at 1.0751, and a rise through could take it to the next resistance level of 1.0805.

Going ahead, market participants will keep a close watch on a speech by the ECB President Mario Draghi, along with a string of crucial economic releases in the Euro-zone, consisting of consumer price index for January, unemployment rate for January and 4Q GDP data, scheduled in a few hours. Also, Germany’s retail sales for December and unemployment rate for January, will also pique significant amount of investor attention.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.