For the 24 hours to 23:00 GMT, the EUR rose 1.12% against the USD and closed at 1.0599, after Germany’s Markit construction PMI advanced to a level of 54.9 in December, expanding at its fastest pace in nine months, driven by a surge in new orders. The PMI had registered a level of 53.9 in the previous month.

Separately, the Euro-zone’s producer price index surprisingly rebounded 0.1% YoY in November, marking its first increase since 2013, compared to a drop of 0.4% in the preceding month, while investors had envisaged the index to fall 0.1%.

The greenback lost ground against a basket of major currencies, after downbeat US private sector jobs data reinforced some doubt on the health of the nation’s labour market.

Data showed that the US ADP private sector employment climbed less-than-expected by 153.0K in December, pointing towards slowdown in the nation’s jobs growth. Markets anticipated private sector to add 175.0K jobs, following a revised gain of 215.0K in the prior month. On the other hand, the nation’s initial jobless claims dropped to a nearly 43-year low level of 235.0K in the week ended 31 December 2016, pointing to further tightening in the labour market. Meanwhile, markets expected for a drop to a level of 260.0K, after recording a revised level of 263.0K in the prior week. Additionally, the nation’s ISM non-manufacturing PMI unexpectedly remained steady at a level of 57.2 in December, maintaining its highest level since October 2015, compared to market expectations of a fall to a level of 56.8. Further, the final Markit services PMI was surprisingly revised higher to a level of 53.9 in December, defying market consensus for it to remain steady at a level of 53.4, recorded in the preliminary print. The index had registered a reading of 54.6 in the prior month.

In the Asian session, at GMT0400, the pair is trading at 1.0585, with the EUR trading 0.13% lower against the USD from yesterday’s close.

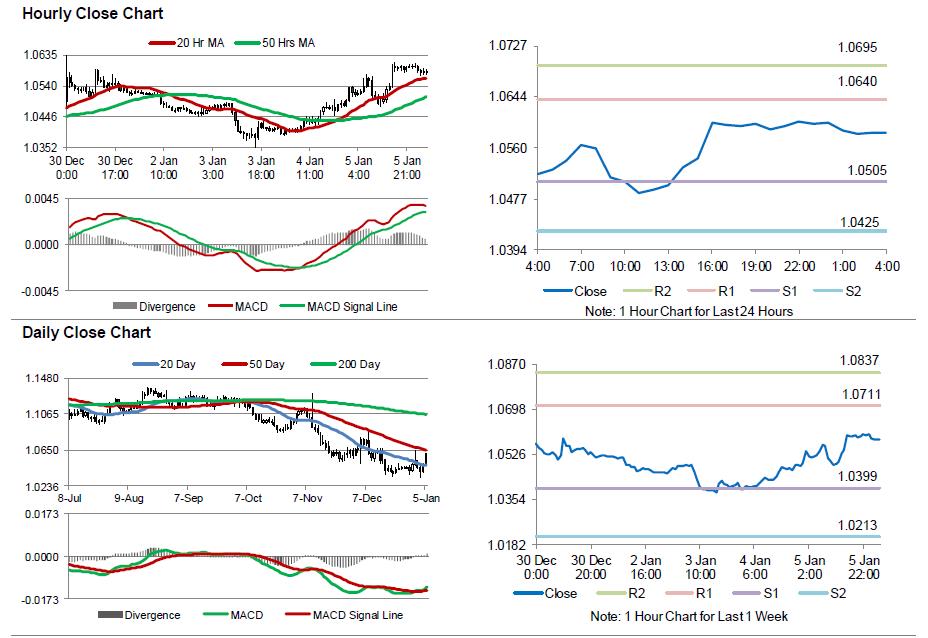

The pair is expected to find support at 1.0505, and a fall through could take it to the next support level of 1.0425. The pair is expected to find its first resistance at 1.0640, and a rise through could take it to the next resistance level of 1.0695.

Trading trends in the Euro today are expected to be determined by the Euro-zone’s final consumer confidence for December and retail sales for November, accompanied with Germany’s factory orders and retail sales data, both for November, all scheduled to release in a few hours. Moreover, traders will eye a raft of economic releases in the US, consisting of non-farm payrolls, unemployment rate and average hourly earnings, all for December along with factory orders, durable goods orders and trade balance, all for November, slated to release later in the day.

The currency pair is trading above its 20 Hr and 50 Hr moving averages.