For the 24 hours to 23:00 GMT, the EUR rose 0.42% against the USD and closed at 1.1242 on Friday.

On the macro front, Germany’s seasonally adjusted factory orders unexpectedly fell 2.6% on a monthly basis in January, amid drop in foreign demand and compared to a drop of 1.6% in the prior month. Markets participants had anticipated factory orders to advance 0.5%.

The US dollar declined against a basket of currencies on Friday, following weaker-than-expected US jobs data.

In the US, data showed that the US non-farm payrolls advanced by 20.0K in February, less than market expectations for a rise of 180.0K and following a revised gain of 311.0K in the prior month.

Meanwhile, the US building permits surprisingly rose 1.4% on a monthly basis to an annual rate of 1345.0K, defying market expectations for a fall to a level of 1287.0K. In the prior month, building permits had recorded a reading of 1326.0K. Moreover, the nation’s housing starts jumped by 18.6% on a monthly basis to an annual rate of 1230.0K in January, beating market expectations for a rise to 1195.0K. Housing starts had recorded a revised level of 1037.0K in the previous month. Additionally, the US unemployment rate fell to 3.8% in February, more than market expectations for a drop to 3.9%. In the preceding month, unemployment rate had registered a reading of 4.0%. Further, the nation’s average hourly earnings of all employees rose 3.4% on an annual basis in February, higher than market consensus for a gain of 3.3%. In the prior month, average hourly earnings of all employees had registered a revised climb of 3.1%.

In the Asian session, at GMT0400, the pair is trading at 1.1233, with the EUR trading 0.08% lower against the USD from Friday’s close.

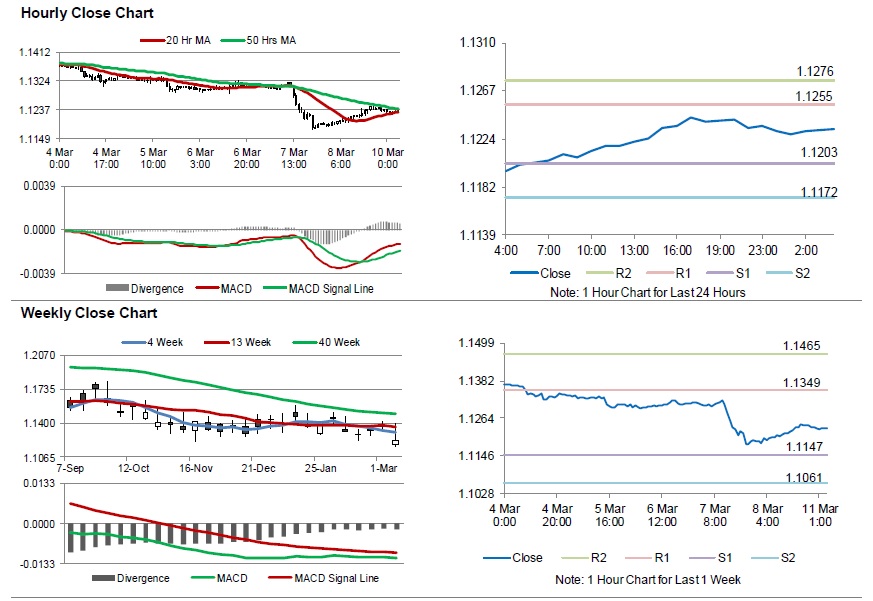

The pair is expected to find support at 1.1203, and a fall through could take it to the next support level of 1.1172. The pair is expected to find its first resistance at 1.1255, and a rise through could take it to the next resistance level of 1.1276.

In absence of key economic releases in the Euro-zone today, investors would keep an eye on Germany’s industrial production and trade balance data, both for January, scheduled to release in a few hours. Later in the day, the US advance retail sales for January and business inventories for December, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.