For the 24 hours to 23:00 GMT, the EUR rose 0.27% against the USD and closed at 1.1691, following robust German factory orders data. Data showed that Germany’s annual factory orders advanced more-than-expected by 4.4% in May, driven by strong domestic demand and compared to a revised rise of 0.8% in the previous month. Market participants had envisaged orders to grow 1.7%.

Separately, the International Monetary Fund (IMF) downgraded its 2018 forecast for German GDP growth to 2.2%, saying rising protectionism.

The US dollar declined against a basket of currencies yesterday, following disappointing economic data.

Data showed that the US private sector employment increased by 177.0K in June, lower than market anticipation for an advance of 190.0K. The private sector employment had recorded a revised increase of 189.0K in the prior month. The number of Americans filling for fresh jobless claims unexpectedly advanced to a level of 231.0K in the week ended 30 June, notching a 6-week high level and compared to a revised level of 228.0K in the prior week. Market participants had anticipated initial jobless claims to drop to a level of 225.0K. Moreover, the final Markit services PMI slid to a level of 56.5 in June, meeting market expectations and confirming the preliminary print. In the prior month, the PMI had recorded a level of 56.8.

As per the minutes of the Federal Reserve’s (Fed) June meeting, policymakers stated that gradual fund rate hikes will support expansion of the economy and maintained its outlook for three rate hikes in 2019. Meanwhile, the policymakers highlighted concerns over growing trade policy risks.

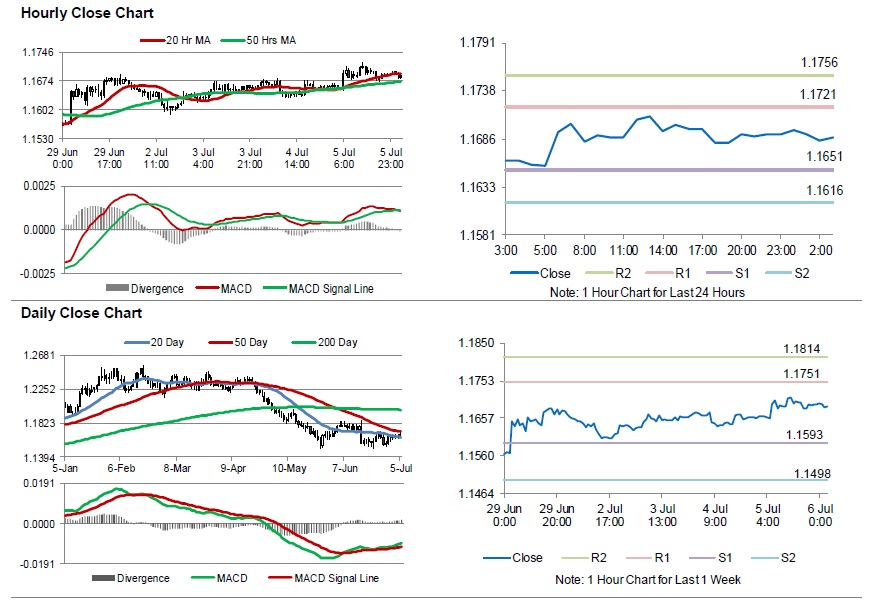

In the Asian session, at GMT0300, the pair is trading at 1.1687, with the EUR trading slightly lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1651, and a fall through could take it to the next support level of 1.1616. The pair is expected to find its first resistance at 1.1721, and a rise through could take it to the next resistance level of 1.1756.

Looking forward, investors would keep an eye on Germany’s industrial production for May, slated to release in a while. Later in the day, the US trade balance data for May, followed by non-farm payrolls data, unemployment rate and average hourly earnings, all for June, will garner significant amount of investor attention.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.