For the 24 hours to 23:00 GMT, the EUR declined 0.2% against the USD and closed at 1.1805, after Germany’s Markit construction PMI fell to a ten-month low level of 53.1 in November, hinting that the nation’s construction sector is losing momentum. In the preceding month, the PMI had recorded a level of 53.3.

On the contrary, the nation’s seasonally adjusted factory orders surprisingly advanced 0.5% on a monthly basis in October, rising for the third straight month, thus suggesting that the nation’s industrial sector would continue to remain on a strong growth path in the last quarter of 2017. Factory orders had registered a revised rise of 1.2% in the prior month, while markets expected for a drop of 0.2%.

The greenback gained ground against its key counterparts, after ADP’s private sector employment in the US advanced by 190.0K in November, meeting market expectations. ADP private sector employment had recorded a gain of 235.0K in the prior month.

Additionally, the nation’s mortgage applications rebounded 4.7% in the week ended 01 December 2017. In the previous week, mortgage applications had recorded a drop of 3.1%.

In the Asian session, at GMT0400, the pair is trading at 1.1804, with the EUR trading marginally lower against the USD from yesterday’s close.

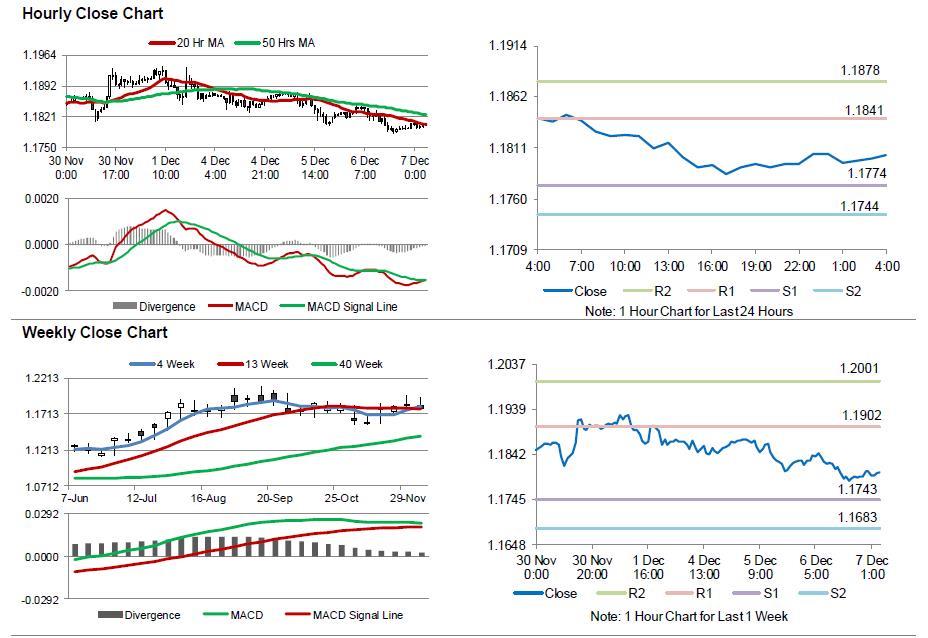

The pair is expected to find support at 1.1774, and a fall through could take it to the next support level of 1.1744. The pair is expected to find its first resistance at 1.1841, and a rise through could take it to the next resistance level of 1.1878.

Going ahead, traders would await a speech by the European Central Bank (ECB) President, Mario Draghi, due later in the day. Moreover, the Euro-zone’s final 3Q GDP figures as well as Germany’s industrial production data for October, will be on investors’ radar. Also, the US initial jobless claims data, followed by consumer credit change for October, will garner a lot of market attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.