For the 24 hours to 23:00 GMT, the EUR declined 0.8% against the USD and closed at 1.1783 on Friday.

In economic news, data showed that Germany’s seasonally adjusted factory orders rose more-than-expected by 1.0% on a monthly basis in June, highlighting a pickup in momentum in the nation’s industrial sector. Factory orders had registered a revised rise of 1.1% in the previous month, while markets were expecting for a gain of 0.5%.

The greenback gained ground against its key counterparts on Friday, after an upbeat US jobs report reinvigorated hopes of another Federal Reserve (Fed) interest rate hike before the end of the year.

Data indicated that non-farm payrolls in the US climbed more-than-expected by 209.0K in July, pointing to further tightening in the nation’s labour market. Non-farm payrolls had registered a revised rise of 231.0K in the prior month, while market participants had anticipated for an advance of 180.0K. Additionally, the nation’s unemployment rate touched a sixteen-year low in July, after it eased to 4.3%, meeting market expectations. Unemployment rate had recorded a level of 4.4% in the prior month.

Moreover, the nation’s average hourly earnings of all employees climbed 0.3% on a monthly basis in July, in line with market expectations, rising by the most in five months. Average hourly earnings of all employees had risen 0.2% in the prior month. Also, the nation’s trade deficit narrowed more-than-anticipated to $43.6 billion in June, as exports surged to a nearly three-year high. Investors had envisaged the nation’s trade deficit to narrow to $44.5 billion, after recording a revised deficit of $46.4 billion in the prior month.

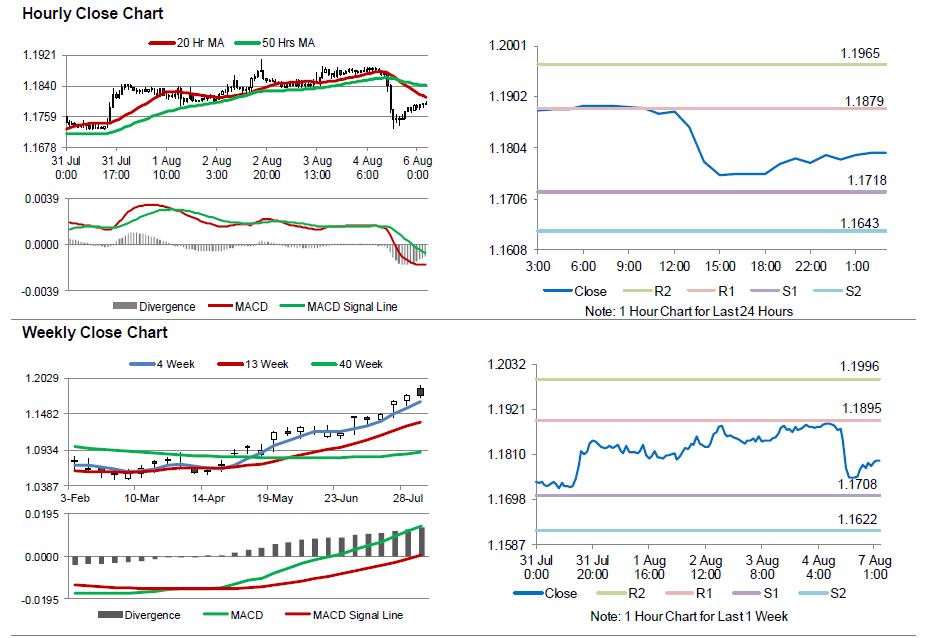

In the Asian session, at GMT0300, the pair is trading at 1.1794, with the EUR trading 0.09% higher against the USD from Friday’s close.

The pair is expected to find support at 1.1718, and a fall through could take it to the next support level of 1.1643. The pair is expected to find its first resistance at 1.1879, and a rise through could take it to the next resistance level of 1.1965.

Ahead in the day, traders will keep a close watch on Germany’s industrial production data for June and the Euro-zone’s Sentix investor confidence data for August. Moreover, the US labour market conditions index for July and consumer credit data for June, slated to release later in the day, will be on investors’ radar.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.