For the 24 hours to 23:00 GMT, the EUR declined 0.19% against the USD and closed at 1.1222, on the back of dismal German factory orders data.

Data showed that Germany’s seasonally adjusted factory orders unexpectedly declined to a two-year low level of 4.2% on a monthly basis in February, amid a slump in foreign demand and defying market consensus for a gain of 0.3%. In the preceding month, factory orders had recorded a drop of 2.6%. Meanwhile, the nation’s construction PMI advanced to a level of 55.6 in March, following a reading of 54.7 in the previous month.

In the US, data showed that seasonally adjusted initial jobless claims surprisingly fell to a level of 202.0K in the week ended 30 March 2019, hitting its lowest level in almost 50 years and confounding market expectations for a rise to a level of 215.0K. In the prior week, initial jobless claims had recorded a revised level of 212.0K.

In the Asian session, at GMT0300, the pair is trading at 1.1225, with the EUR trading marginally higher against the USD from yesterday’s close.

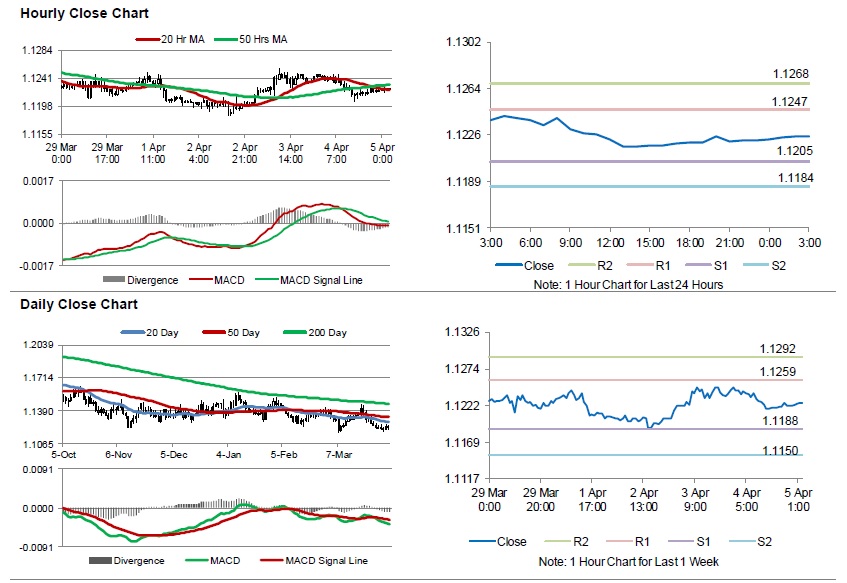

The pair is expected to find support at 1.1205, and a fall through could take it to the next support level of 1.1184. The pair is expected to find its first resistance at 1.1247, and a rise through could take it to the next resistance level of 1.1268.

Going ahead, traders would await Germany’s industrial production for February, set to release in a few hours. Later in the day, the US non-farm payrolls, unemployment rate and average hourly earnings, all for March, will pique significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.