For the 24 hours to 23:00 GMT, the EUR declined 0.34% against the USD and closed at 1.1276.

On the macro front, Germany’s Gfk consumer confidence index unexpectedly fell to a level of 10.4 in April, defying market expectations of a steady reading. In the prior month, the index had registered a revised reading of 10.7.

Separately, the US dollar rose against the euro yesterday, following a rebound in 10-year US Treasury yields.

In the US, data indicated that the US housing starts tumbled to an 8-month low level of 8.7% on a monthly basis, to an annual rate of 1162.0K in February, compared to a revised level of 1273.0K in the previous month. Markets participants had anticipated housing starts to fall to a level of 1210.0K. Moreover, the nation’s building permits dropped 1.6% on a monthly basis, to an annual rate of 1296.0K, compared to a revised level of 1317.0K in the previous month. Markets had expected building permits to decline to a level of 1305.0K. Also, the CB consumer confidence index unexpectedly fell to 124.1 in March, marking its lowest level in 16-months and defying market consensus for a rise to a level of 132.5. The index had registered a reading of 131.4 in the prior month. Additionally, the Richmond Fed manufacturing index declined to a level of 10.0 in March, compared to a level of 16.0 in the previous month.

On the flipside, the US housing price index climbed 0.6% on a monthly basis in January, surpassing market expectations for an advance of 0.4%. The index had registered a rise of 0.3% in the previous month.

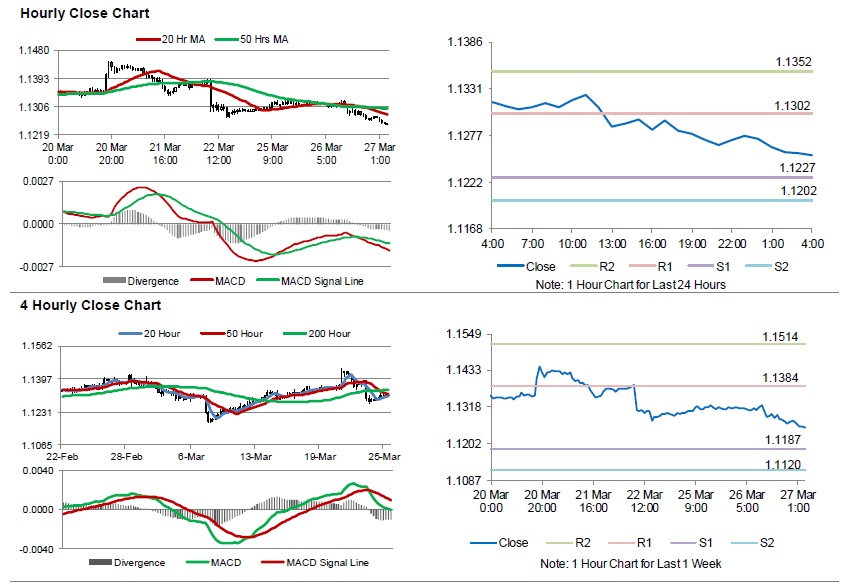

In the Asian session, at GMT0400, the pair is trading at 1.1253, with the EUR trading 0.20% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1227, and a fall through could take it to the next support level of 1.1202. The pair is expected to find its first resistance at 1.1302, and a rise through could take it to the next resistance level of 1.1352.

Looking forward, traders would await the European Central Bank’s President Mario Draghi’s speech, due in a while. Later in the day, the US trade balance data for January along with the MBA mortgage applications, will keep traders on their toes.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.