For the 24 hours to 23:00 GMT, the EUR declined 0.08% against the USD and closed at 1.1014.

On the data front, Germany’s Ifo business expectations index rose to a level of 92.1 in November, less than market expectations for an increase to a level of 92.5. In the previous month, the index had registered a revised level of 91.6. Meanwhile, the Ifo current assessment index climbed to a level of 97.9 in November, at par with market anticipations. In the preceding month, the index had registered a reading of 97.8. Moreover, the nation’s Ifo business climate index advanced to a level of 95.0 in November, in line with market expectations. In the prior month, the index had recorded a revised level of 94.7.

In the US, data showed that the Dallas Fed manufacturing business index unexpectedly advanced to a level of -1.3 in November, defying market expectations for a to fall to a level of -11.3. In the prior month, the index had registered a reading of -5.1. On the other hand, the US Chicago Fed national activity index unexpectedly dropped to a level of -0.71 in November, confounding market consensus for a rise to a level of -0.43. In the previous month, the index had recorded a reading of -0.45.

In the Asian session, at GMT0400, the pair is trading at 1.1014, with the EUR trading flat against the USD from yesterday’s close.

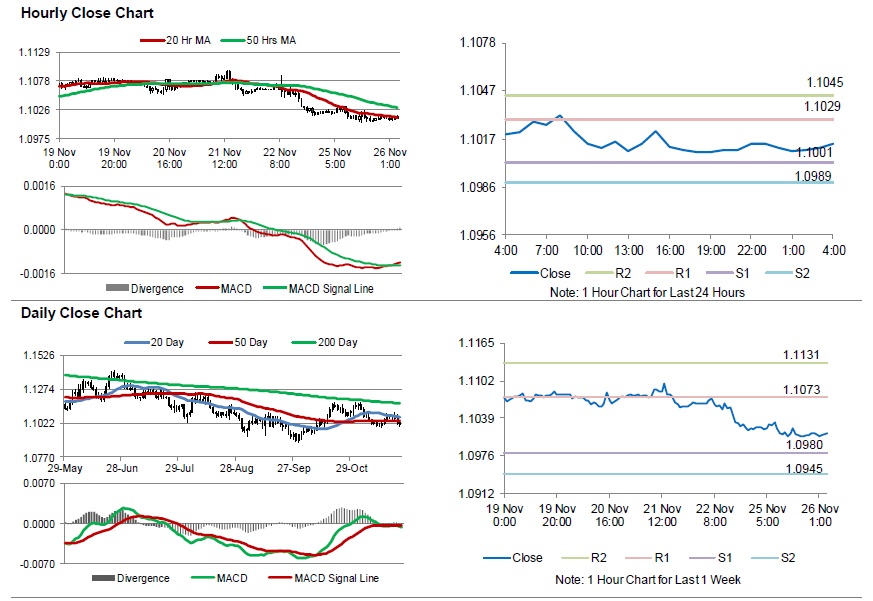

The pair is expected to find support at 1.1001, and a fall through could take it to the next support level of 1.0989. The pair is expected to find its first resistance at 1.1029, and a rise through could take it to the next resistance level of 1.1045.

Going forward, traders would await Germany’s GfK consumer confidence index for December, set to release in a few hours. Later in the day, the US housing price index for September along with goods trade balance and new home sales, both for October, will keep investors on their toes. Additionally, the Richmond Fed manufacturing index and the consumer confidence index, both for November, will pique significant amount of investors’ attention.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.