For the 24 hours to 23:00 GMT, the EUR declined 0.39% against the USD and closed at 1.1100.

On the data front, Germany’s Ifo business expectations index fell to a seven-year low level of 91.3 in August, amid rising fears of recession and more than market expectations for a drop to a level of 91.8. The index had registered a revised reading of 92.1 in the prior month. Moreover, the nation’s Ifo business climate index declined to a level of 94.3 in August, compared to a revised reading of 95.8 in the previous month. Market participants had envisaged the index to drop to a level of 95.0. Also, the Ifo current assessment index dropped to a level of 97.3 in August, higher than market anticipations for a fall to a level of 98.8. In the previous month, the index had recorded a revised level of 99.6.

In the US, data showed that the Dallas Fed manufacturing business index rose to a level of 2.7 in August, surpassing market consensus for an advance to a level of -4.0. In the preceding month, the index had registered a reading of -6.3. Further, the nation’s preliminary durable goods orders climbed 2.1% on a monthly basis in July, compared to a revised gain of 1.9% in the previous month. Market participants had anticipated durable goods orders to record a rise of 1.2%. On the other hand, the US Chicago Fed National Activity Index fell to a level of -0.36 in July, defying market expectations for a flat reading. In the prior month, the index had recorded a revised reading of 0.03.

On Friday, the Federal Reserve (Fed) Chairman, Jerome Powell, in his annual remarks at the Jackson Hole Symposium, stated that the global economic outlook “has been deteriorating” and there is no “rulebook” on trade wars. Additionally, he cautioned that the escalating trade war between the US and China, due to Trump’s trade policy is contributing to the slowdown. Meanwhile, he pledged that the Fed “will act as appropriate” to sustain the US economic expansion.

In the Asian session, at GMT0300, the pair is trading at 1.1105, with the EUR trading 0.05% higher against the USD from yesterday’s close.

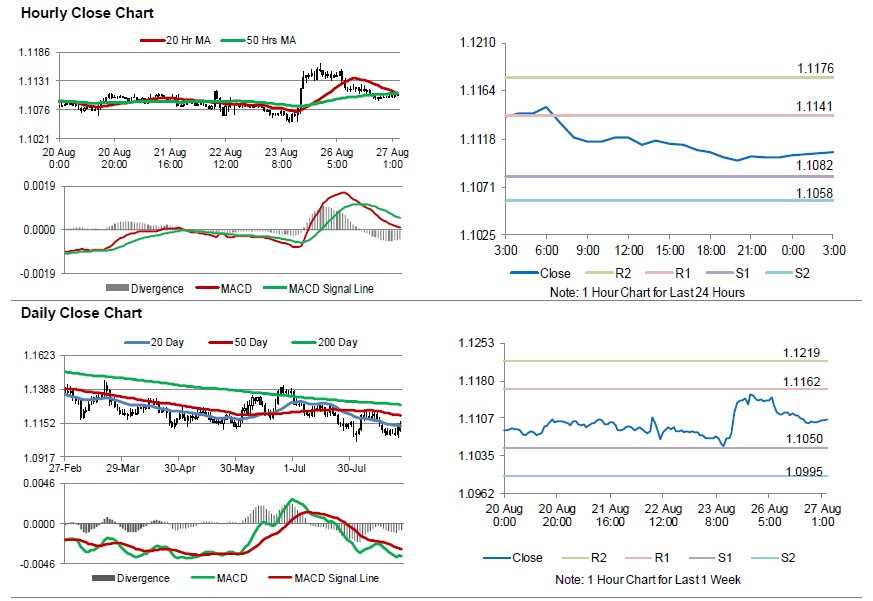

The pair is expected to find support at 1.1082, and a fall through could take it to the next support level of 1.1058. The pair is expected to find its first resistance at 1.1141, and a rise through could take it to the next resistance level of 1.1176.

Moving ahead, traders would await Germany’s gross domestic product for the second quarter, set to release in a few hours. Later in the day, the US house price index for June along with the Richmond Fed manufacturing index and consumer confidence index, both for August, will be on investor’s radar.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.