For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1197.

The European Central Bank (ECB) President, Mario Draghi, stated that the central bank would continue to maintain its inflation target as the ECB’s extraordinary stimulus is successful in creating more than 10 million employment opportunities leading to higher wages.

On the data front, Germany’s seasonally adjusted industrial production unexpectedly climbed 0.5% on a monthly basis in March, rising for the second straight month and defying market consensus for a fall of 0.5%. In the previous month, industrial production had recorded a revised gain of 0.4%.

The US dollar declined against Euro, amid possibilities that trade tensions between the US and China could escalate.

In the US, data indicated that the MBA mortgage applications advanced 2.7% on a weekly basis in the week ended 03 May 2019, following a decline of 4.3% in the previous week.

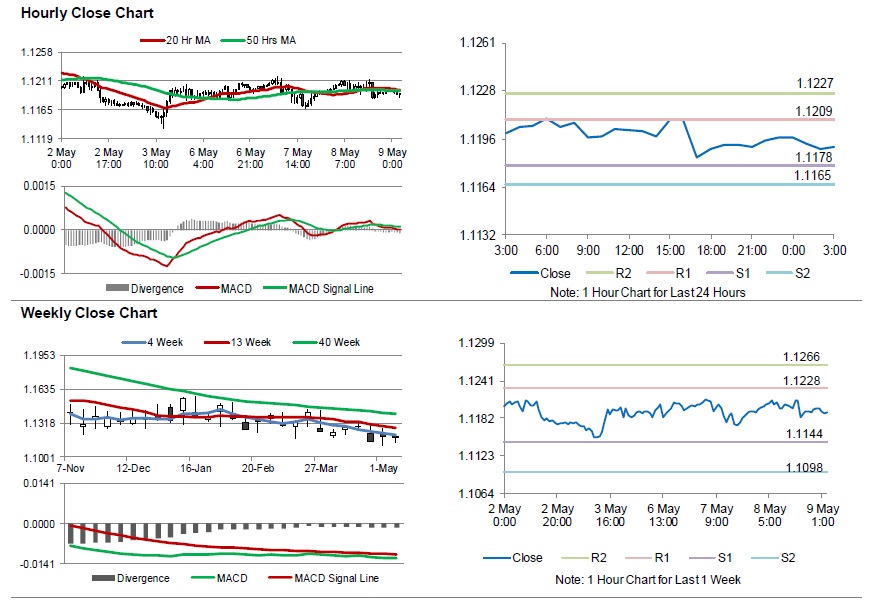

In the Asian session, at GMT0300, the pair is trading at 1.1191, with the EUR trading 0.05% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1178, and a fall through could take it to the next support level of 1.1165. The pair is expected to find its first resistance at 1.1209, and a rise through could take it to the next resistance level of 1.1227.

Amid lack of macroeconomic releases in the Euro-zone today, the US trade balance data for March and the producer price index for April along with initial jobless claims, will garner significant amount of investor attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.