For the 24 hours to 23:00 GMT, the EUR declined 0.45% against the USD and closed at 1.1056 on Friday.

On the data front, Germany’s seasonally adjusted industrial production unexpectedly eased 1.7% on a monthly basis in October, declining at its fastest pace since 2009 and defying market consensus for a rise of 0.1%. Industrial production had recorded a decline of 0.6% in the previous month.

The US dollar gained ground against its major peers, amid upbeat US jobs data.

In the US, data showed that the non-farm payrolls advanced by the most in 10 months by 266.0K in November, higher than market expectations of a rise of 180.0K. Non-farm payrolls had recorded a revised increase of 156.0K in the prior month. Moreover, the US unemployment rate unexpectedly declined to its lowest level in 50 years to 3.5% in November, compared to 3.6% in the prior month. Market participants had anticipated unemployment rate to remain unchanged. Additionally, the flash Reuters/Michigan consumer sentiment index advanced to a 7-month high level of 99.2 in December, surpassing market anticipations for a rise to a level of 97.0. In the prior month, the index had recorded a level of 96.8. Also, the US consumer credit increased by $18.9 billion in October, more than market expectations for an advance of $16.0 billion. Consumer credit had recorded a revised rise of $9.6 billion in the prior month. Meanwhile, the nation’s average hourly earnings of all employees rose 0.2% on a monthly basis in the US, less than market forecast. In the previous month, average hourly earnings of all employees had risen by a revised 0.4%.

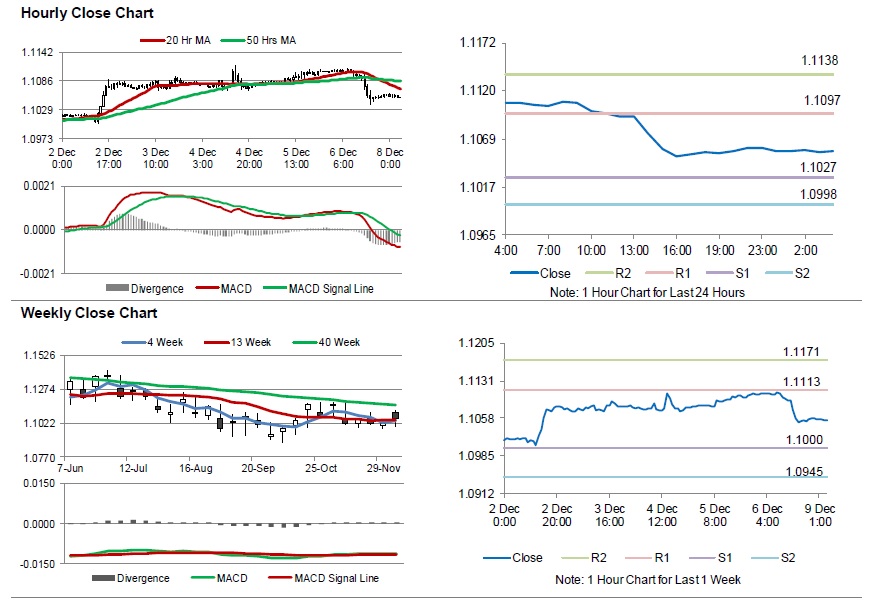

In the Asian session, at GMT0400, the pair is trading at 1.1055, with the EUR trading a tad lower against the USD from Friday’s close.

The pair is expected to find support at 1.1027, and a fall through could take it to the next support level of 1.0998. The pair is expected to find its first resistance at 1.1097, and a rise through could take it to the next resistance level of 1.1138.

Amid lack of macroeconomic releases in the US today, traders would keep an eye on Euro-zone’s Sentix investor confidence index for December along with Germany’s trade balance for October, set to release in a few hours.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.