For the 24 hours to 23:00 GMT, the EUR rose 0.2% against the USD and closed at 1.0641.

On Thursday, data showed that Germany’s final consumer price index (CPI) advanced 0.2% MoM in March, meeting market expectations and following a similar rise in the prior month.

In the US, the NAHB housing market index dropped more-than-anticipated to a level of 68.0 in April, from a nearly twelve-year high level of 71.0 in the preceding month and compared to market expectations for the index to edge down to a level of 70.0.

On Friday, data indicated that consumer prices in the US surprisingly dropped 0.3% on a monthly basis in March, dropping for the first time in thirteen months. The CPI had registered a gain of 0.1% in the prior month, while markets anticipated for a flat reading. Moreover, the nation’s advance retail sales declined for a second consecutive month, after it eased 0.2% in March, in line with market expectations and following a revised drop of 0.3% in the preceding month. In contrast, the nation’s business inventories advanced 0.3% in February, following a similar gain in the previous month.

On Thursday, data revealed that the US flash Reuters/Michigan consumer sentiment index unexpectedly rose to a level of 98.0 in April, as Americans remained increasingly optimistic over the nation’s current economic conditions. The index had recorded a reading of 96.9 in the previous month, while market participates were expecting for a fall to a level of 96.5. Moreover, the nation’s initial jobless claims unexpectedly fell to a level of 234.0K in the week ended 08 April, while investors had envisaged for an advance to a level of 245.0K and after registering a revised reading of 235.0K in the preceding month.

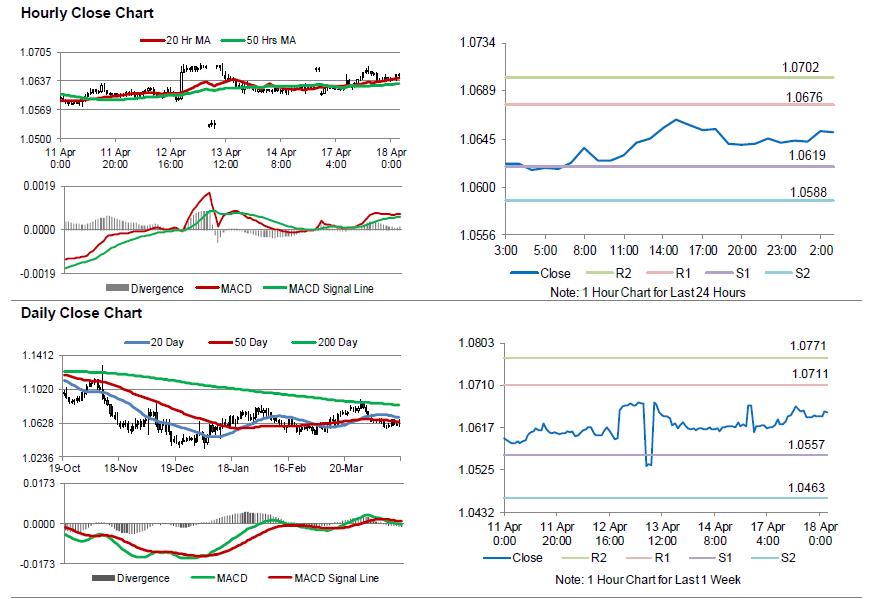

In the Asian session, at GMT0300, the pair is trading at 1.0651, with the EUR trading 0.09% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0619, and a fall through could take it to the next support level of 1.0588. The pair is expected to find its first resistance at 1.0676, and a rise through could take it to the next resistance level of 1.0702.

With no major economic releases in the Euro-zone today, investors would look forward to a batch of economic releases in the US, consisting of housing starts, building permits, industrial production as well as manufacturing production data, all for March, scheduled to release later today.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.