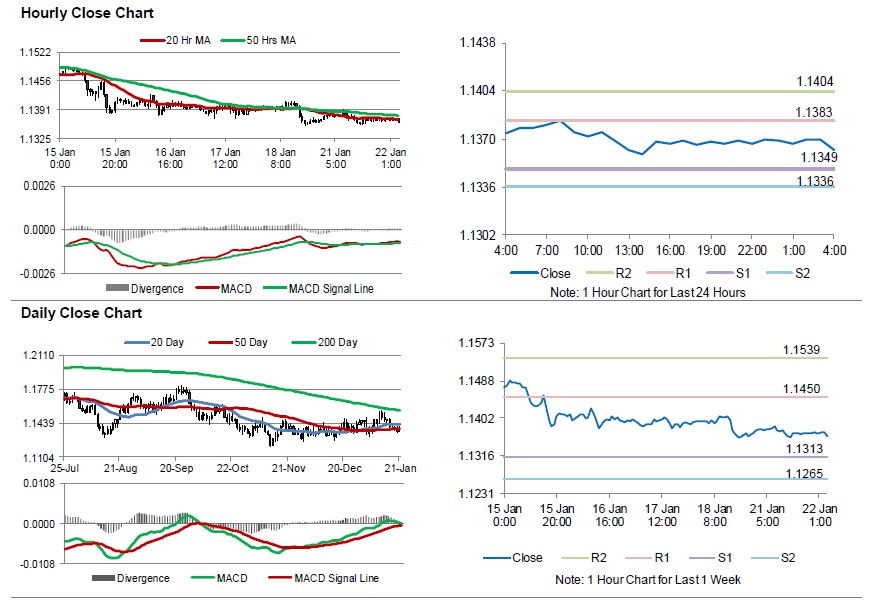

For the 24 hours to 23:00 GMT, the EUR slightly rose against the USD and closed at 1.1370.

Data indicated that the Germany’s producer price inflation slowed to a 7-month low level of 2.7% on an annual basis in December, falling short of market anticipation for a gain of 2.9%. In the prior month, the PPI had recorded a rise of 3.3%.

In the Asian session, at GMT0400, the pair is trading at 1.1362, with the EUR trading 0.07% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.1349, and a fall through could take it to the next support level of 1.1336. The pair is expected to find its first resistance at 1.1383, and a rise through could take it to the next resistance level of 1.1404.

Looking ahead, investors would await the Euro-zone’s and Germany’s ZEW survey indices, all for January, scheduled to release in a few hours. Later in the day, the US existing home sales for December, will keep traders on their toes.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.