For the 24 hours to 23:00 GMT, the EUR declined 0.25% against the USD and closed at 1.0733.

On the data front, Germany’s producer price index rose 3.1% on an annual basis in February, notching its highest level in over five years, amid a surge in energy prices. However, the index fell short of market expectations of a rise of 3.2%, while following a gain of 2.4% in the previous month.

Separately, according to the Bundesbank monthly report, the German economy has continued to expand and will do so in the foreseeable future, on the back of robust industrial output.

In the US, the Chicago Federal Reserve (Fed) President, Charles Evans, reiterated the Fed’s view that two more interest rate hikes this year are likely and added that the central bank will possibly wait at least until June to decide on the next interest rate hike. Nevertheless, he also added that four rate rises this year isn’t totally out of the realm of possibility, if the economy “really” picks up and inflation tops the Fed’s 2.0% target.

On the data front, the US Chicago Fed national activity index advanced to a level of 0.34 in February, compared to a revised reading of -0.02 in the previous month, whereas investors had envisaged the index to climb to a level of 0.03.

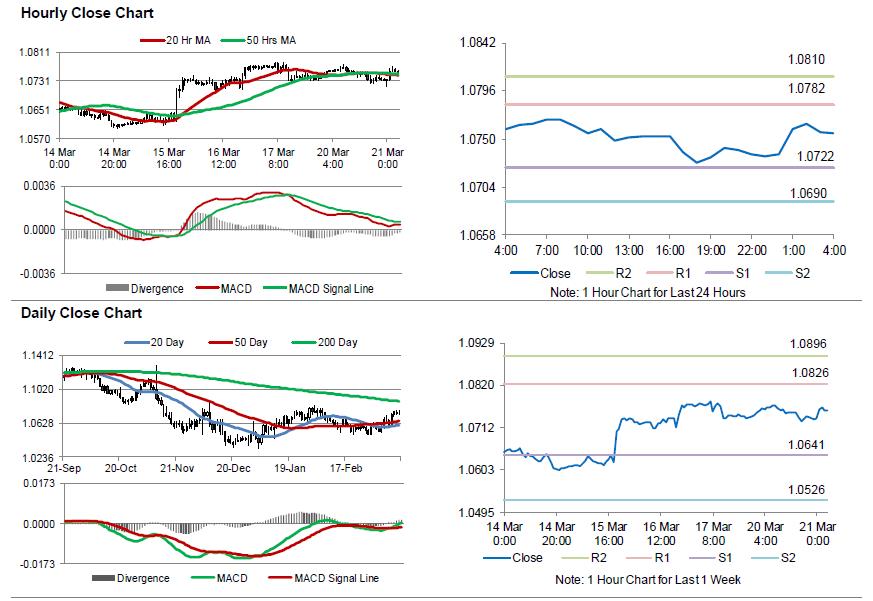

In the Asian session, at GMT0400, the pair is trading at 1.0755, with the EUR trading 0.2% higher against the USD from yesterday’s close.

The pair is expected to find support at 1.0722, and a fall through could take it to the next support level of 1.0690. The pair is expected to find its first resistance at 1.0782, and a rise through could take it to the next resistance level of 1.0810.

Amid no economic releases across the Euro-zone today, market participants will closely monitor comments from a host of Fed officials, scheduled later in the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.