For the 24 hours to 23:00 GMT, the EUR marginally declined against the USD and closed at 1.1094.

Data showed that Germany’s producer price index fell 0.2% on a yearly basis in December, less than market expectations for a fall of 0.6% and compared to a drop of 0.7% in the previous month.

Separately, the International Monetary Fund (IMF) has downgraded global growth forecasts for 2020 and 2021. The IMF expects 2020 global economic growth of 3.3%, down from 3.4% estimated previously in October. Further, the US growth forecast for 2020 was cut by 0.1 percentage point to 2%. The economy is expected to expand 1.7% in 2021. Additionally, Euro-zone’s growth outlook for this year was lowered by 0.1 percentage point to 1.3%, which is slightly higher than the estimated 1.2% expansion in 2019.

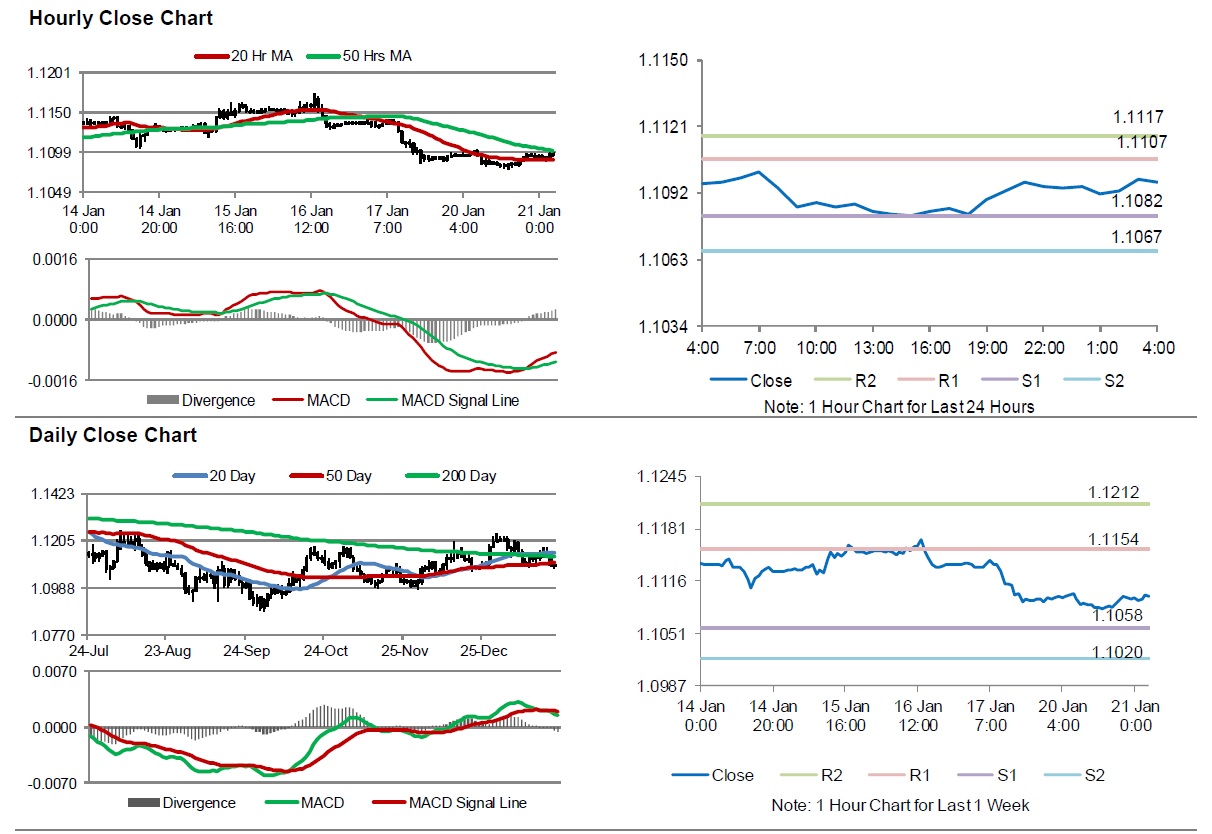

In the Asian session, at GMT0400, the pair is trading at 1.1097, with the EUR trading a tad higher against the USD from yesterday’s close.

The pair is expected to find support at 1.1082, and a fall through could take it to the next support level of 1.1067. The pair is expected to find its first resistance at 1.1107, and a rise through could take it to the next resistance level of 1.1117.

With no major macroeconomic releases in the US today, investors would focus on Euro-zone’s ZEW economic sentiment index for January along with Germany’s ZEW survey indices for January, set to release in a few hours.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.