For the 24 hours to 23:00 GMT, the EUR rose 0.52% against the USD and closed at 1.1803, after data indicated that Germany’s seasonally adjusted trade surplus climbed more-than-anticipated to €20.0 billion in August, as growth in exports outpaced that of imports, thus soothing concerns that a surge in Euro would impact German trade. In the prior month, the nation had registered a revised trade surplus of €19.3 billion, while markets had expected for a surplus of €19.5 billion.

The International Monetary Fund (IMF), in its twice-yearly World Economic Outlook, revised up the Euro-zone’s growth forecast by 0.2% for both 2017 and 2018 to 2.1% and 1.9% respectively, amid a strong economic recovery. Additionally, the organisation raised its global growth economic forecast for 2017, citing brightening prospects in the world’s biggest economies. It now projects the global economy to grow 3.6% this year and 3.7% next, both up by 0.1%. However, the organisation warned that medium-term risks to global economic growth are tilted to the downside, highlighting threats from tightening financial conditions and sluggish inflation in advanced economies.

The greenback lost ground against a basket of currencies, amid concerns that the US President, Donald Trump’s tax overhaul plan would stall.

In the US, data showed that the NFIB small business optimism index declined to a level of 103.0 in September, more than market expectations for a drop to a level of 105.0. The index had registered a reading of 105.3 in the prior month. Additionally, the nation’s IBD/TIPP economic optimism index surprisingly eased to a level of 50.3 in October, defying market expectations for a rise to a level of 54.2 and following a level of 53.4 in the preceding month.

Meanwhile, the IMF maintained its growth outlook for the US at 2.2% in 2017 and 2.3% in 2018.

In the Asian session, at GMT0300, the pair is trading at 1.1803, with the EUR trading flat against the USD from yesterday’s close.

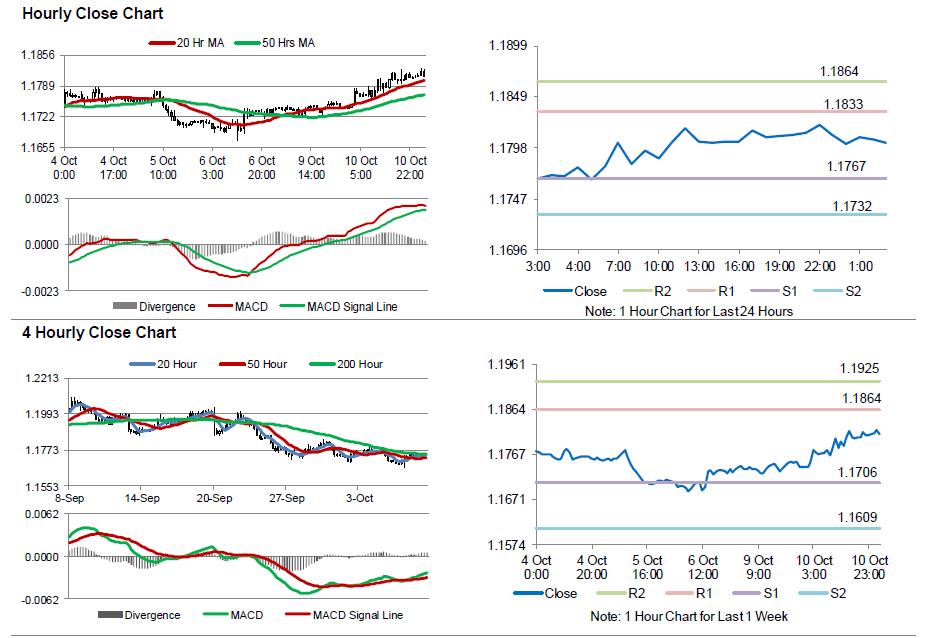

The pair is expected to find support at 1.1767, and a fall through could take it to the next support level of 1.1732. The pair is expected to find its first resistance at 1.1833, and a rise through could take it to the next resistance level of 1.1864.

Amid a lack of macroeconomic releases in the Euro-zone today, investors would anxiously await the release of latest FOMC meeting minutes, due later in the day, which may shed further light on the central bank’s monetary policy trajectory. Additionally, the release of US MBA mortgage applications followed by JOLTS job openings for August, will be on investors’ radar.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving average.