For the 24 hours to 23:00 GMT, the EUR declined 0.07% against the USD and closed at 1.1768 on Friday, after Germany’s seasonally adjusted trade surplus narrowed more-than-expected to €18.9 billion in October, as exports recorded a surprise fall, while imports jumped. Markets had anticipated the nation to post a trade surplus of €21.9 billion, compared to a surplus of €24.1 billion in the previous month.

The US Dollar advanced against its key counterparts on Friday, after the latest jobs data boosted optimism over the health of the US labour market. However, gains were capped as investors were disappointed with weak wage growth data.

Non-farm payrolls in the US rose more-than-anticipated by 228.0K in November, suggesting that the nation’s labour market continues to develop in a positive way and cementing expectations of a Federal Reserve (Fed) interest rate hike later this week. In the preceding month, non-farm payrolls had registered a revised increase of 244.0K, while investors had envisaged for a rise of 195.0K. Additionally, the nation’s unemployment rate remained unchanged at a 17-year low of 4.1% in November, meeting market expectations.

However, the nation’s average hourly earnings of all employees rebounded less-than-expected by 0.2% MoM in November, thus hinting that inflationary pressures will likely remain subdued. Average hourly earnings of all employees recorded a revised drop of 0.1% in the previous month, while markets were expecting for a gain of 0.3%.

Other data indicated that the flash Reuters/Michigan consumer sentiment index in the US registered an unexpected fall to a level of 96.8 in December, declining to a three-month low and confounding market expectations of an advance to a level of 99.0. In the previous month, the index had registered a reading of 98.5.

In the Asian session, at GMT0400, the pair is trading at 1.1780, with the EUR trading 0.1% higher against the USD from Friday’s close.

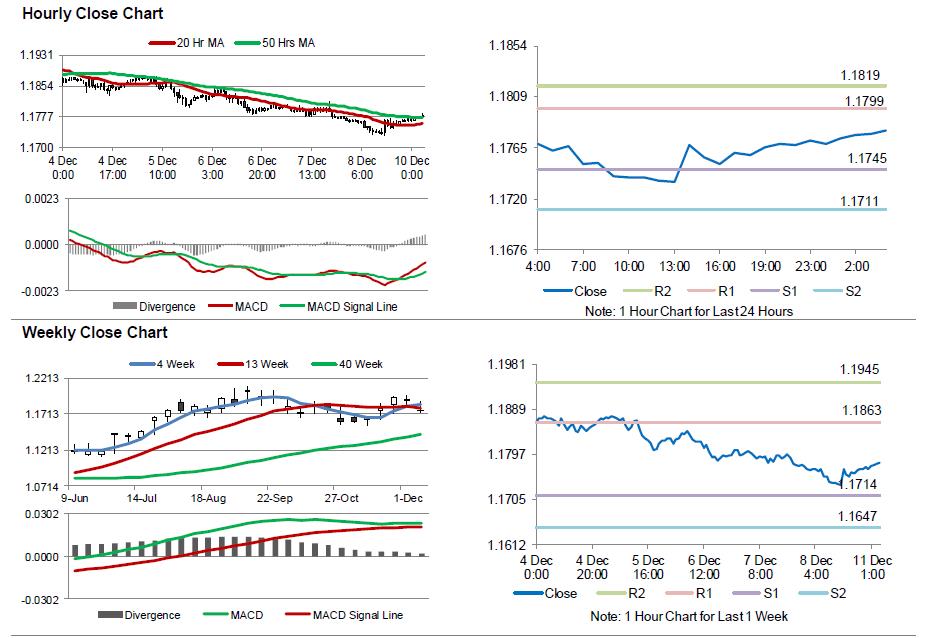

The pair is expected to find support at 1.1745, and a fall through could take it to the next support level of 1.1711. The pair is expected to find its first resistance at 1.1799, and a rise through could take it to the next resistance level of 1.1819.

Amid a lack of any key economic releases in the Euro-zone today, investors will look forward to the US JOLTs job openings data for October, due to release later in the day.

The currency pair is trading above its 20 Hr moving average and showing convergence with its 50 Hr moving average.