For the 24 hours to 23:00 GMT, the EUR declined 0.32% against the USD and closed at 1.0945 on Friday.

Data showed that Germany’s trade surplus widened to €19.2 billion in December, driven by a rise in exports and compared to a revised surplus of €18.5 billion in the previous month. Meanwhile, the region’s industrial production dropped 3.5% on a monthly basis in December, registering its biggest drop in more than a decade and compared to a revised rise of 1.2% in the prior month.

The US dollar rose against a basket of currencies, on the back of robust US jobs data.

In the US, data showed that the non-farm payrolls jumped more-than-expected by 225.0K in January, compared to a revised level of 147.0K in the previous month. Market participants had expected employment to rise by 160.0K. Additionally, average hourly earnings climbed 3.1% on an annual basis in January, compared to a revised rise of 3.0% in the prior month. Further, consumer credit increased by $22.1 billion in December, marking its highest level in five months. In the prior month, consumer credit had recorded a revised rise of $11.8 billion. Meanwhile, the unemployment rate unexpectedly increased to 3.6% in January, compared to 3.5% in the earlier month.

In the Asian session, at GMT0400, the pair is trading at 1.0953, with the EUR trading 0.07% higher against the USD from Friday’s close.

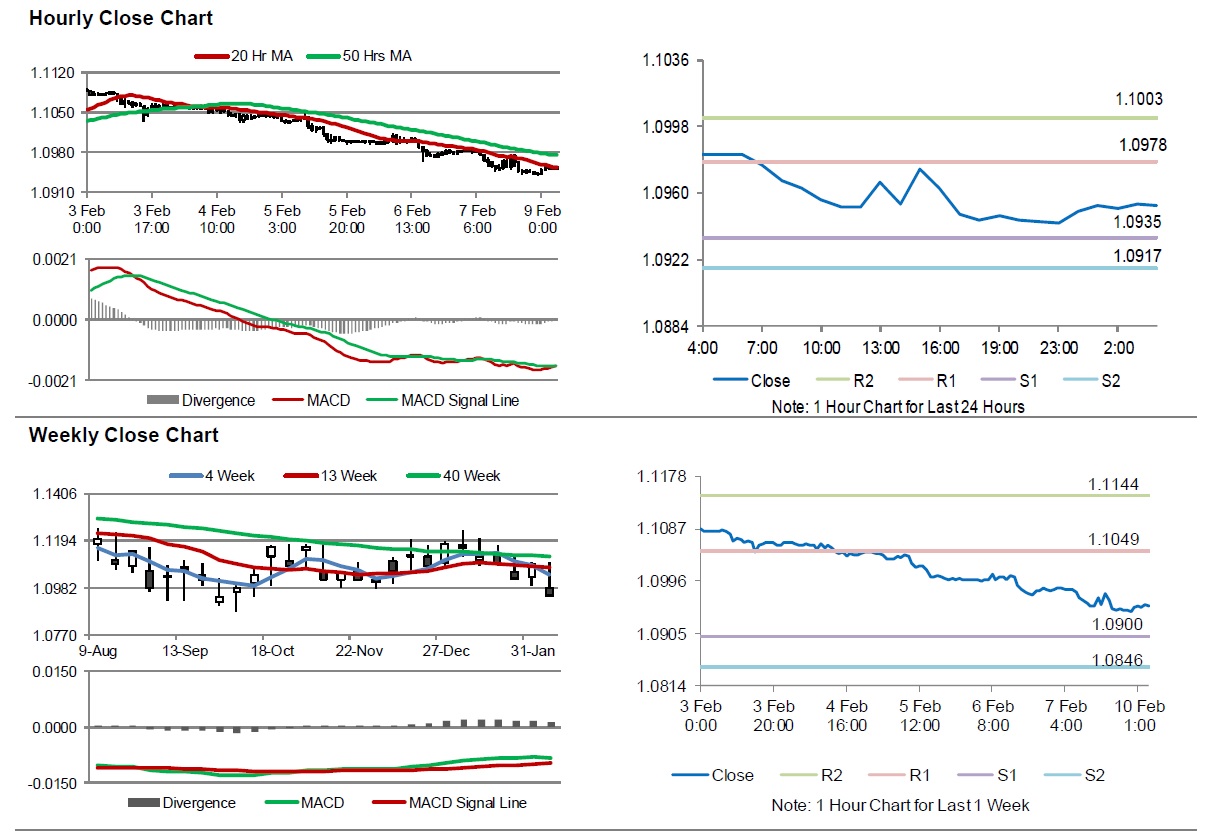

The pair is expected to find support at 1.0935, and a fall through could take it to the next support level of 1.0917. The pair is expected to find its first resistance at 1.0978, and a rise through could take it to the next resistance level of 1.1003.

With no macroeconomic releases in the US today, traders would look forward to Euro-zone’s Sentix investor confidence for February, slated to release in a few hours.

The currency pair is showing convergence with its 20 Hr moving average and trading below its 50 Hr moving average.