On Friday, the EUR 1174.00 declined 0.27% against the USD and closed at 1.1173.

In economic news, M3 money supply in the Euro-zone advanced rose 5.00% on an annual basis in May, less than market expectations for a rise of 5.40%, following a rise of 5.30% in the previous month. Meanwhile, the import price index in Germany unexpectedly fell 0.20% in May MoM, compared to an advance of 0.60% in the prior month. Markets were anticipating it to climb 0.20%.

In the US, the final Reuters/Michigan consumer sentiment index climbed to a level of 96.10 in June, compared to a reading of 90.70 in the previous month. Markets were expecting it to advance to a level of 94.60.

In the Asian session, at GMT0300, the pair is trading at 1.1017, with the EUR trading 1.4% lower from Friday’s close.

Over the weekend, the Euro-zone finance ministers rejected a request from Greece for an extension of its bailout by a month, resulting in Greece going into a phase of high uncertainty and increasing worries about an exit from the Euro-zone.

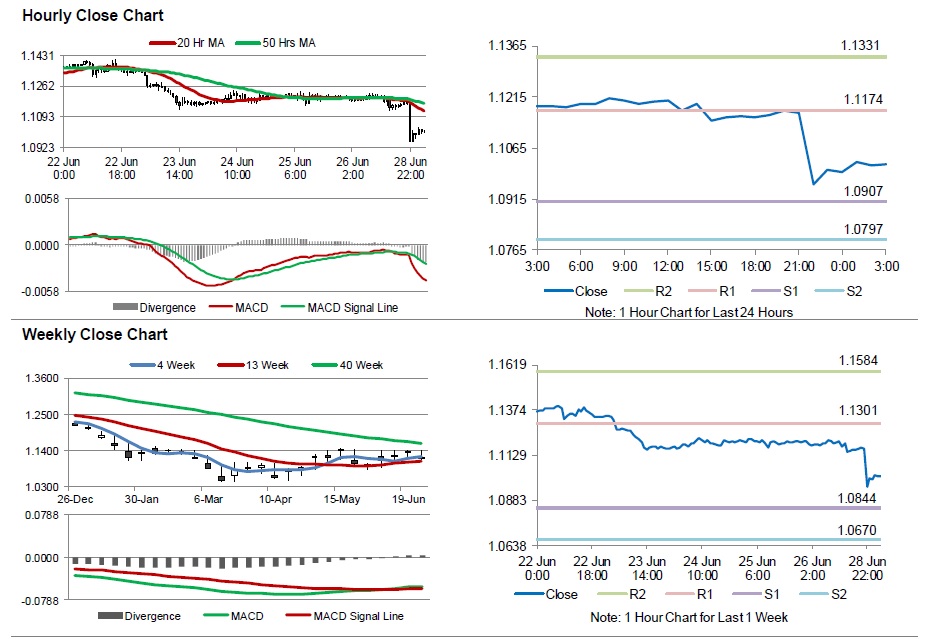

The pair is expected to find support at 1.0907, and a fall through could take it to the next support level of 1.0797. The pair is expected to find its first resistance at 1.1174, and a rise through could take it to the next resistance level of 1.1331.

Trading trends in the Euro today are expected to be determined by Germany’s CPI data scheduled in a few hours. Meanwhile, uncertainty regarding Greece’s financial woes would continue to hamper investor sentiment.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.