For the 24 hours to 23:00 GMT, the EUR traded marginally lower against the USD and closed at 1.0835.

Yesterday, the IMF announced that the Greek government repaid them €2.05 billion overdue debt and is no longer in arrears to the agency. The debt ridden nation had missed a crucial payment of €1.6 billion to the IMF on 30 June, but was able to make the payment after the European Union granted Greece a short-term loan of €7 billion. Meanwhile, the Greek banks also reopened, after it remained shuttered for close to three weeks.

In other economic news, Germany’s producer price index fell 0.1% MoM in June, in line with consensus expectations and compared to unchanged reading in the previous month. Meanwhile, the Euro-zone’s seasonally adjusted current account surplus narrowed to €18.0 billion in May, from previous month’s surplus of €22.3 billion.

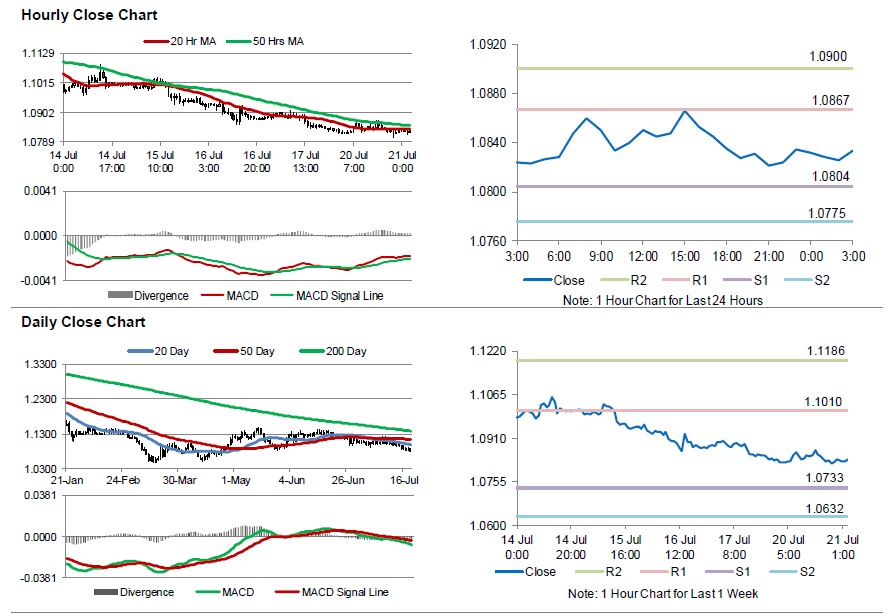

In the Asian session, at GMT0300, the pair is trading at 1.0833, with the EUR trading marginally lower from yesterday’s close.

The pair is expected to find support at 1.0804, and a fall through could take it to the next support level of 1.0775. The pair is expected to find its first resistance at 1.0867, and a rise through could take it to the next resistance level of 1.0900.

Trading trends in the Euro today would be governed by the future course of action of the Greek government, with investors monitoring key developments on this front.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.