On Friday, the EUR rose 0.17% against the USD and closed at 1.1107,

In economic news, Germany’s final services PMI edged up to a level of 53.80 in June, compared to a level of 53.0 in the previous month, while markets were expecting services PMI to advance to a level of 54.2. Meanwhile, the final print of services PMI in the Euro-zone climbed to 54.4 in June, from a level of 53.8 registered in the previous month.

Other economic data showed that retail sales in the single-currency bloc rose more than expected by 0.2% MoM in May, compared to prior month’s 0.7% increase.

In the Asian session, at GMT0300, the pair is trading at 1.1043, with the EUR trading 0.58% lower from Friday’s close.

Over the weekend, people in Greece voted against accepting the creditors’ deal for its bailout. The outcome revealed that more than 62% voted “No” to Euro-zone’s rescue package, indicating that the result will lead to the nation’s possible departure from the Euro-zone. The rejection also implied that the people in Greece backed the nation’s PM Alexis Tsipras’ call for a no more austerity measures in the debt ridden nation.

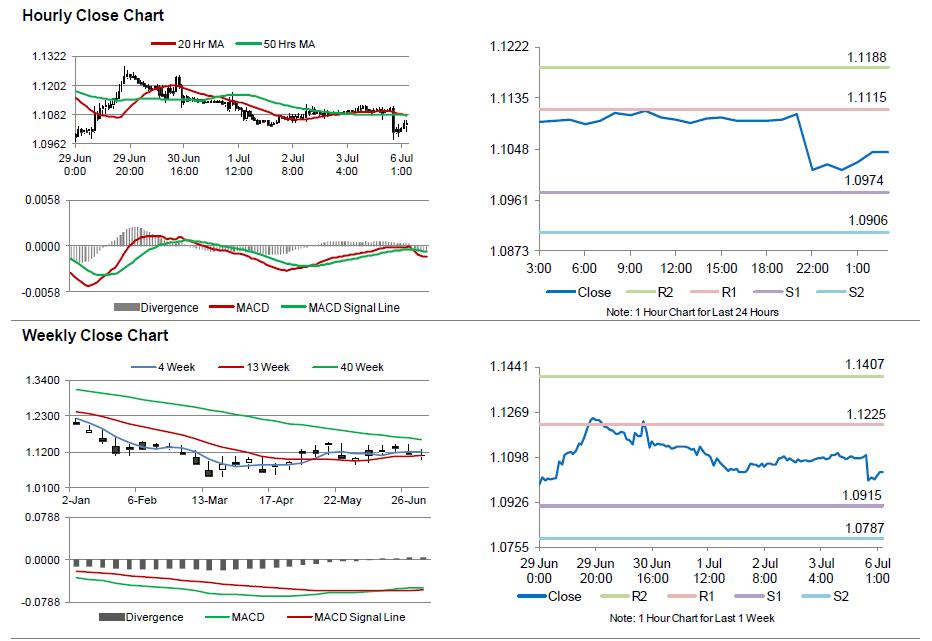

The pair is expected to find support at 1.0974, and a fall through could take it to the next support level of 1.0906. The pair is expected to find its first resistance at 1.1115, and a rise through could take it to the next resistance level of 1.1188.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.