For the 24 hours to 23:00 GMT, EUR declined marginally against the USD and closed at 1.3516.

The US Dollar advanced against the single currency after two Fed officials hinted a continuation in the reduction of the central bank’s bond-purchases in the coming months. The Richmond Fed President, Jeffrey Lacker projected that the central bank would probably keep reducing its monthly asset purchases at its current pace and stated that the hurdle for pausing such a taper would be very high. Separately, Chicago Fed President, Charles Evans opined that the cuts to the Fed’s massive bond-buying programme have been “reasonable” and that the pace of its reductions has been “modest.” However, at the same time, he also reiterated his view for the short-term policy rate to remain near zero until late 2015.

Meanwhile, in the Euro-zone, a report showed that the producer inflation rate rose 0.2% (MoM) in December, compared to a 0.1% decline recorded in November. Another report revealed that Italy’s consumer price index advanced 0.2% (MoM) in January, in-line with market estimates and compared to a similar pace of rise witnessed in the preceding month.

In the Asian session, at GMT0400, the pair is trading at 1.3513, with the EUR trading slightly lower from yesterday’s close.

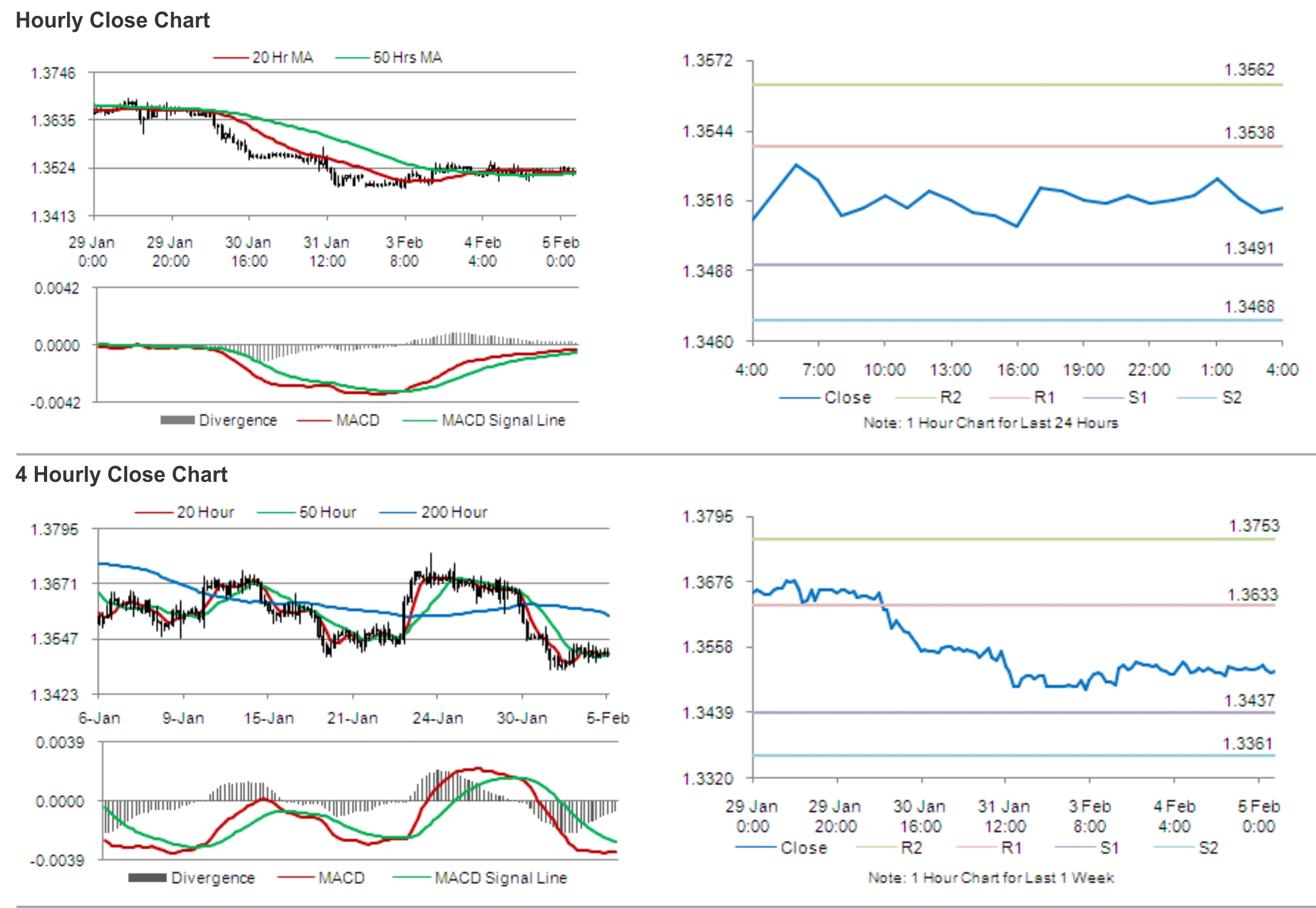

The pair is expected to find support at 1.3491, and a fall through could take it to the next support level of 1.3468. The pair is expected to find its first resistance at 1.3538, and a rise through could take it to the next resistance level of 1.3562.

During the later course of the day, Markit Economics is scheduled to release the Euro-zone’s service and composite PMI data, ahead of the Eurostat’s retail sales data.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.