For the 24 hours to 23:00 GMT, the EUR rose 0.18% against the USD and closed at 1.3630, as demand for the greenback declined following the latest batch of soft economic releases from the US economy. Revised data showed that the US economy shrank at an annualised rate of 2.9% in the first quarter of 2014, its worst performance in five years while another report revealed that US durable goods orders unexpectedly fell by a seasonally adjusted 1.0% in May for the first time in four months. However, Markit PMI for the US service sector rose more-than-expected to a reading of 61.2 in June from previous month’s level of 58.1. Meanwhile, during his speech at a conference in Boston, Fed Governor, Daniel Tarullo, cautioned the US banks of a tougher stress test.

In the Euro-zone, an ECB Governing Council member, Luis Maria Linde, hinted that the central bank was mulling an asset-purchase programme in the Euro-zone economy, despite knowing that financial markets in the region remained fragmented. However, another ECB policymaker, Jens Weidmann, urged the ECB to refrain from its plans to purchase securitised debt, as he felt that such a move by the central bank could turn it into “the bad bank of Europe by taking risks off banks and passing them onto the taxpayer.” Meanwhile, French national statistics bureau, Insee, projected the domestic economy to expand 0.7% in 2014, which failed to meet President, Francois Hollande’s government’s expectations for a 1.0% growth this year. Additionally, Insee forecasted jobless rate in Euro-zone’s second largest economy to edge up to 10.2% in the second quarter from 10.1% in the first quarter.

In other economic news, the Gfk forward-looking index on German consumer confidence rose to a reading of 8.9 for July, the highest level since 2006 while Insee’s business climate indicator in France fell to a level of 92 in June, from a figure of from 94 in May.

In a noteworthy event, S&P’s Head of sovereign ratings for Europe, Middle East and Africa, Moritz Kraemer, indicated that the Euro-zone’s member countries would have to do a lot of work for cutting debt and getting their economies into better shape to clinch a rating upgrade.

In the Asian session, at GMT0300, the pair is trading at 1.3633, with the EUR trading a tad higher from yesterday’s close.

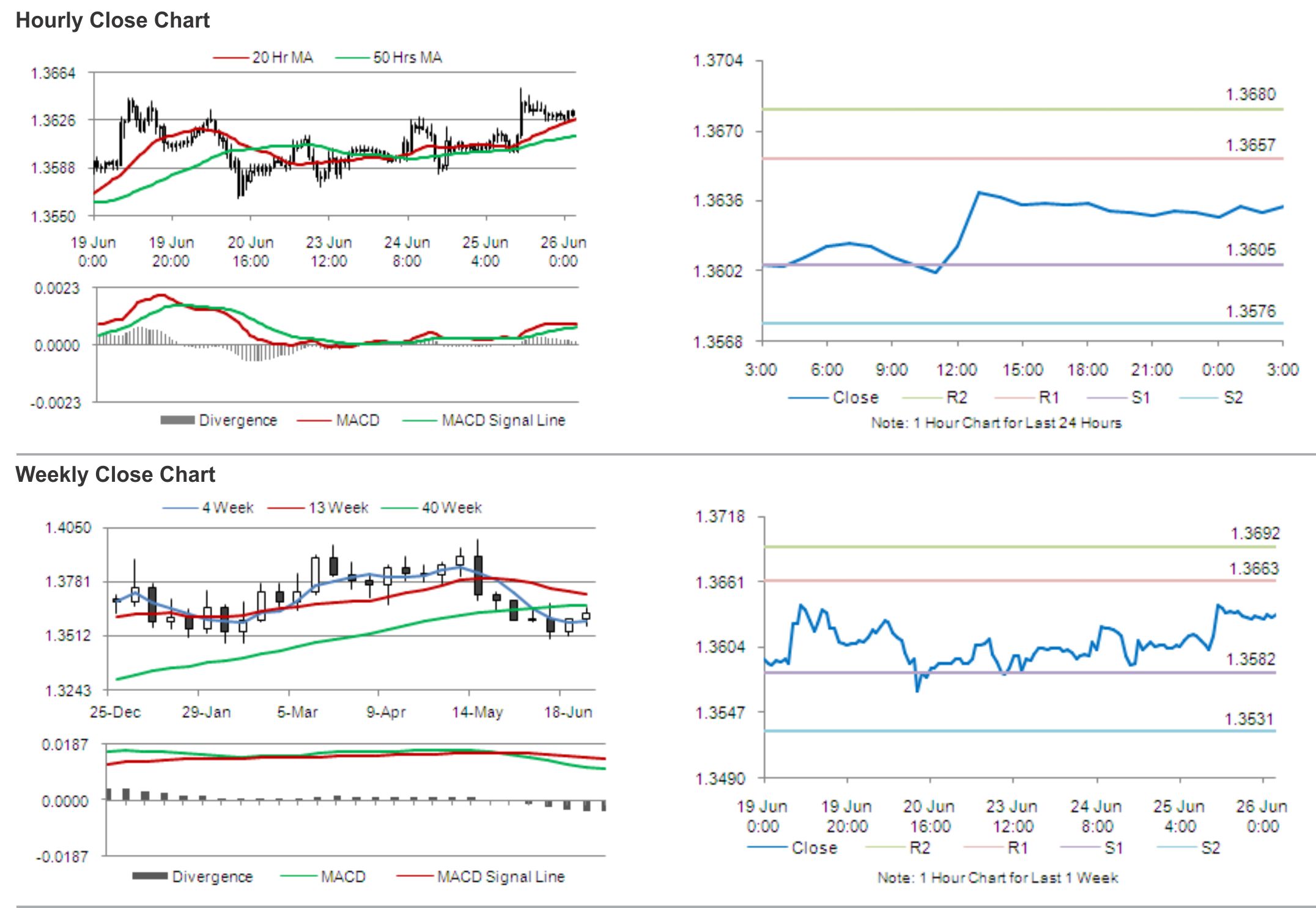

The pair is expected to find support at 1.3605, and a fall through could take it to the next support level of 1.3576. The pair is expected to find its first resistance at 1.3657, and a rise through could take it to the next resistance level of 1.3680.

Amid a lack of major economic releases in the Euro-zone economy, traders would eye global economic news, along with weekly US jobless claims data, for further cues in the currency pair.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.