For the 24 hours to 23:00 GMT, the EUR declined 0.05% against the USD and closed at 1.1069.

On the data front, Euro-zone’s final Markit services PMI advanced to a level of 52.2 in October, more than market expectations for a rise to a level of 51.8. In the prior month, the PMI had registered a reading of 51.6, while preliminary figures had indicated a rise to a level of 51.8. Moreover, the region’s seasonally adjusted retail sales climbed more-than-expected by 3.1% on a yearly basis in September, compared to a revised rise of 2.7% in the prior month. Market participants had envisaged retail sales to increase 2.5%. Separately, in Germany, the Markit final services PMI unexpectedly rose to a level of 51.6 in October, compared to a reading of 51.4 in the prior month. Both market participants and preliminary figures had indicted a decline to a level of 51.2. Further, the nation’s seasonally adjusted factory orders rose 1.3% on a monthly basis in September, surpassing market consensus for an advance of 0.1%. In the prior month, factory orders had recorded a revised drop of 0.4%.

In a major news, the International Monetary Fund (IMF) downgraded its 2019 global growth forecast to 3.0%, the slowest pace since the 2008 financial crisis and down from a 3.8% pace seen in 2017. However, the organisation projected global growth to improve to 3.4% in 2020. Moreover, the IMF lowered Euro-zone’s growth forecast to 1.2% in 2019 and to 1.4% in 2020, amid concerns over slowdown in the region’s manufacturing sector and global trade tensions. Further, it trimmed its growth forecast for Germany to 0.5% in 2019 from 0.8% predicted in April. Meanwhile, the IMF now expects the US economy to grow by 2.1% next year, but considerably weaker than the 4% President Donald Trump promised earlier in his presidency.

In the US, data showed that the MBA mortgage applications fell 0.1% on a weekly basis in the week ended 01 November 2019, following a rise of 0.6% in the prior week.

In the Asian session, at GMT0400, the pair is trading at 1.1059, with the EUR trading 0.09% lower against the USD from yesterday’s close.

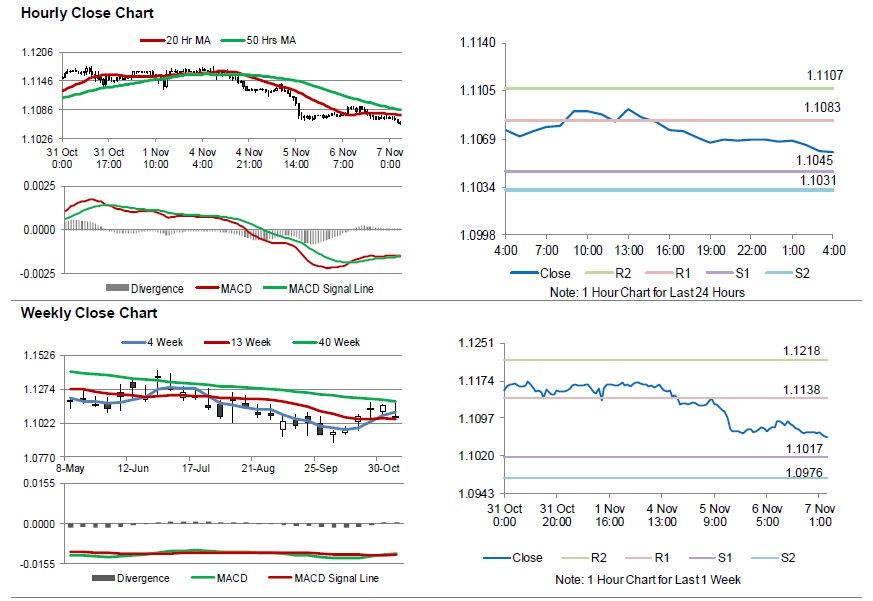

The pair is expected to find support at 1.1045, and a fall through could take it to the next support level of 1.1031. The pair is expected to find its first resistance at 1.1083, and a rise through could take it to the next resistance level of 1.1107.

Looking ahead, traders would await Euro-zone’s economic bulletin report along with Germany’s industrial production for September, slated to release in a few hours. Later in the day, the US consumer credit data for September along with initial jobless claims, will garner significant amount of investors’ attention.

The currency pair is trading below its 20 Hr and 50 Hr moving averages.