On Friday, EUR rose 0.06% against the USD and closed at 1.3873, as easing tensions on Ukraine and lingering optimism on the growth-outlook of the Euro-zone economy improved traders’ appetite for risk-taking. Meanwhile, an upbeat rise in the German industrial production data for January also benefitted the Euro-zone’s common currency.

In the US, the New York Fed President, William Dudley hinted that, despite the improving economic condition of the US economy, the US Fed would not back-off from its highly accommodative policy stance. Furthermore, he was optimistic about the long-term recovery prospect of the nation and opined that market speculation for an interest rate hike by the mid of 2015 seems “reasonable.”

On the economic front, the US economy added 175,000 jobs in February, more than analysts’ expectations for an addition of 150,000 jobs and compared to 129,000 jobs added in the previous month. However, despite the upbeat US non-farm payrolls data, unemployment rate in the economy rose to 6.7% in February, defying market estimates for the unemployment rate to remain unchanged at previous month’s level of 6.6%. Another report showed that trade deficit in the US widened more-than-expected to $39.10 billion in January, from a deficit of $38.98 billon, registered in the preceding month. Separately, data revealed that the US consumer credit registered a rise of $13.7 billion in January, failing to meet market projections for a rise of $14.0 billion and compared to an increase of $15.9 billion recorded in December.

In the Asian session, at GMT0400, the pair is trading at 1.3885, with the EUR trading 0.09% higher from Friday’s close.

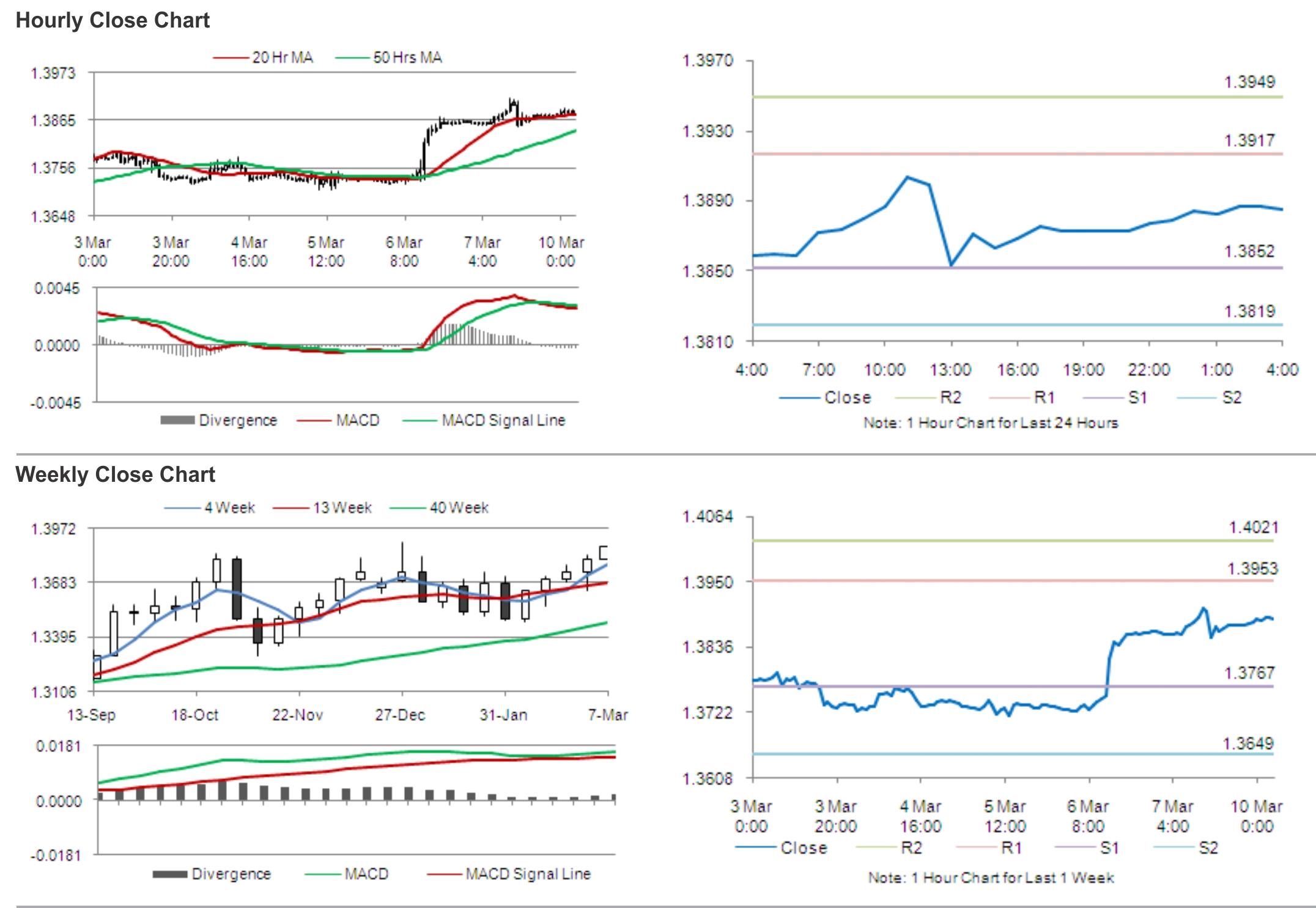

The pair is expected to find support at 1.3852, and a fall through could take it to the next support level of 1.3819. The pair is expected to find its first resistance at 1.3917, and a rise through could take it to the next resistance level of 1.3949.

Traders keenly await Euro-zone’s Sentix investor confidence data for further cues in the Euro.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.