On Friday, EUR rose 0.06% against the USD and closed at 1.3531, reversing its initial loses after tensions escalated in Ukraine and Israel. Meanwhile, the common currency continued to remain under pressure after the US and the EU imposed the most aggressive sanctions to date on Russian businesses.

On the macro front, the current account surplus of the Euro-zone narrowed to €19.5 billion in May, from a revised surplus of €21.6 billion in the previous month. Markets were anticipating a current account surplus of €23.0 billion in May.

On Friday, the ECB Governing Council member Jens Weidmann, cautioned that the ultra-loose monetary policy of the central bank in the region should not be extended for a longer period of time, and further hinted that it has done its bit for the economy and the central bank should go ahead with hiking its interest rates, whenever circumstances arise.

Similarly, German Finance Minister, Wolfgang Schaeuble also warned the ECB that its loose monetary policy should not go on continuing, as its runs the risk of causing asset bubbles.

Furthermore, the IMF Chief, Christine Lagarde noted that the ECB should maintain its flexible policy for some time as the inflation rate continues to be low in the regions. She added that the central bank should undertake appropriate measures as the unemployment and debt continued to remain at elevated levels in the region.

The US Dollar came under pressure, after data released on Friday indicated that consumer sentiment from Thomson Reuters and the University of Michigan unexpectedly eased to 81.3 in early July, from 82.5 the month prior. Market had expected it to rise to a level of 83.0. Additionally, the Conference Board’s leading indicator in the US registered a lesser-than-expected 0.3% rise in June, compared to a revised rise of 0.7% in the previous month.

In the Asian session, at GMT0300, the pair is trading at 1.3531, with the EUR trading flat from yesterday’s close.

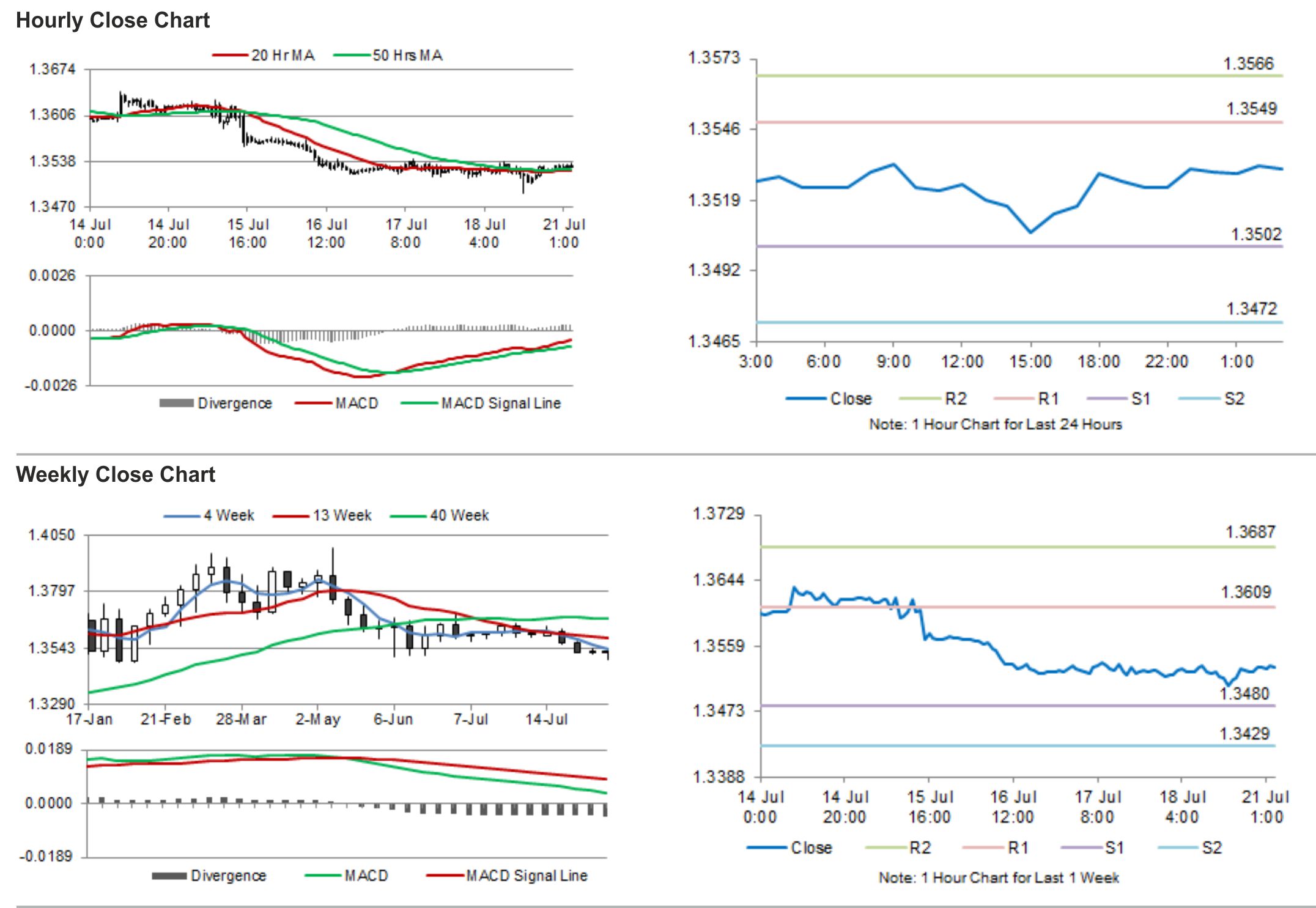

The pair is expected to find support at 1.3502, and a fall through could take it to the next support level of 1.3472. The pair is expected to find its first resistance at 1.3549, and a rise through could take it to the next resistance level of 1.3566.

Traders would await producer inflation data from Germany and Chicago Fed National Activity data from the US, to be released later during the day.

The currency pair is showing convergence with its 20 Hr and 50 Hr moving averages.