For the 24 hours to 23:00 GMT, the EUR rose 0.10% against the USD and closed at 1.3853. However, gains in the Euro-zone’s common currency were capped as the US Dollar regained some lost ground after US pending home sales climbed 3.4% (MoM) in March, the largest increase since May 2011 and after the Dallas Fed manufacturing business index surpassed analysts’ expectations and jumped to a reading of 11.7 in April.

In the Euro-zone, the ECB President, Mario Draghi projected low inflation to persist in the Euro-zone economy for some more time but also hinted that the central bank is still far off from implementing QE measures to bolster economic recovery in the region. Meanwhile, the ECB Vice President, Vitor Constancio cautioned that, despite the recent progress made by the Euro-zone economy, the economy still faces several challenges and is not entirely out of the danger zone. Separately, another ECB policymaker, Christian Noyer opined that a stronger Euro is a powerful deflationary factor as it adds to the problem of uncomfortably low inflation, which according to him could persist for some more time in the Euro-zone economy. However, German Bundesbank stated that it did not see any evidence of low-inflation in the Euro-zone economy at present but at the same time it projected German economic growth to slow down significantly in the second quarter of 2014.

On the economic front, data from Euro-zone’s member nations showed that, consumer confidence in Italy jumped to a four-year high reading of 105.4 in April while Germany’s import prices fell most since August 2013 in March.

In the Asian session, at GMT0300, the pair is trading at 1.3861, with the EUR trading 0.06% higher from yesterday’s close.

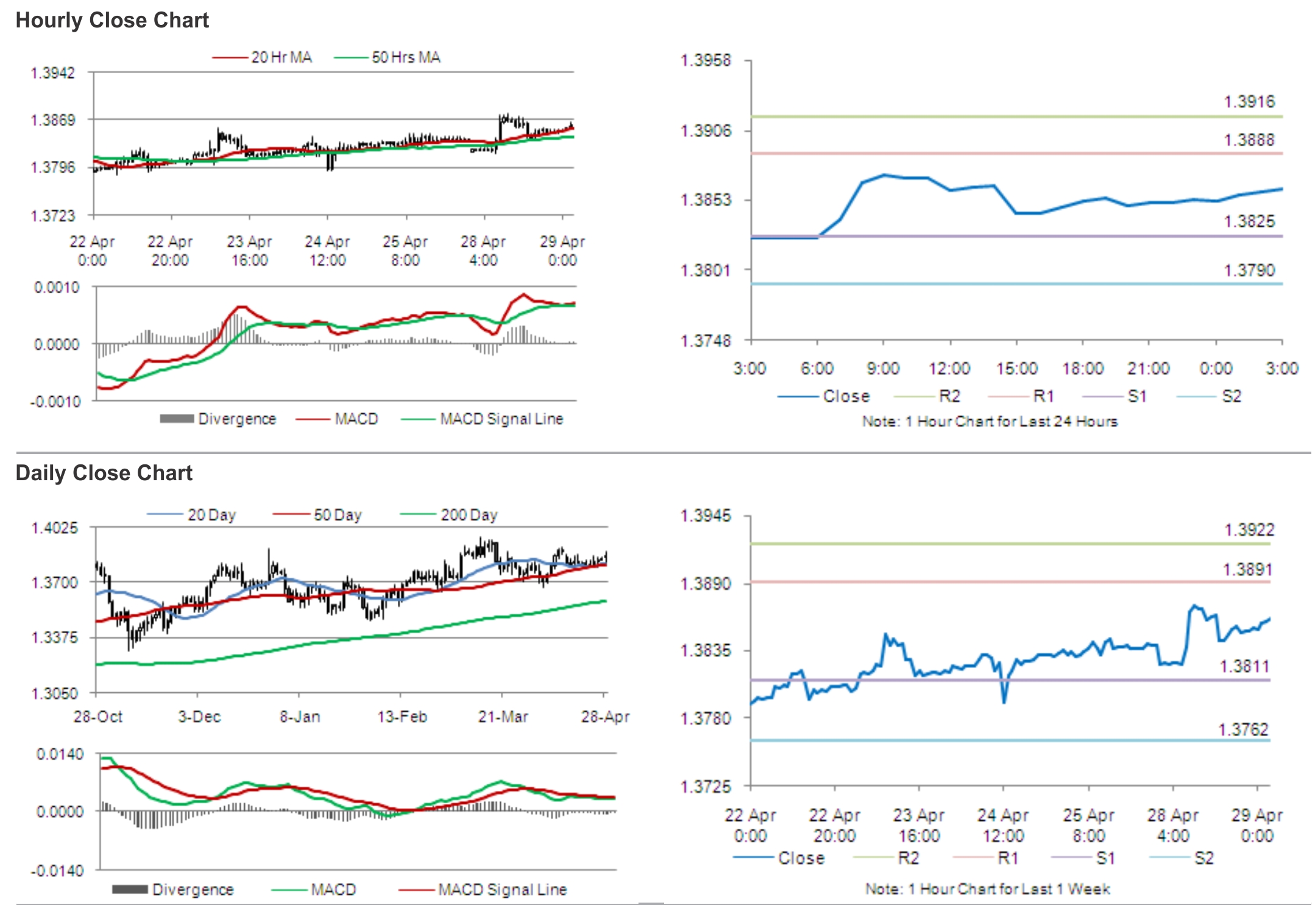

The pair is expected to find support at 1.3825, and a fall through could take it to the next support level of 1.3790. The pair is expected to find its first resistance at 1.3888, and a rise through could take it to the next resistance level of 1.3916.

In a slew of economic releases, later today, traders would give maximum attention to Euro-zone’s economic sentiment, consumer confidence and Germany’s consumer inflation data, for further cues in the Euro. Meanwhile, the Federal Reserve will commence its monthly monetary policy meeting later today, which would have a considerable influence on determining the trend in the US Dollar going forward.

The currency pair is showing convergence with its 20 Hr moving average and is trading above its 50 Hr moving average.