On Friday, EUR declined 0.15% against the USD and closed at 1.3702. However, earlier during the day, the US Dollar came under pressure after data showed that US non-farm payrolls rose by a seasonally adjusted 192,000 in March, failing to meet analysts’ expectations for a 200,000 increase in payrolls. Adding to the negative sentiment was another report that showed unemployment rate in the US stood pat at previous month’s level of 6.7% in March, contradicting market estimates for the unemployment rate to decline to 6.6%. Meanwhile, during his speech in Hong Kong, Dallas Fed President, Richard Fisher termed the US Fed’s present pace of bond buying as “still somewhat promiscuous” and projected the same to end by October if the central bank continues tapering at the current pace.

In the Euro-zone, an ECB Executive Board member, Benoit Coeure hinted that he did not see the need for further quantitative easing measures in the Euro-zone but at the same time he also highlighted the need for lower interest rates to nurture the fragile recovery in the region’s economy. Separately, the ECB Vice President, Vitor Constancio opined that economic recovery in the Euro-zone’s periphery nations would make it easier for the central bank to buy their bonds as part of a general asset-purchase program. Furthermore, citing an improvement in Europe’s fundamentals, he indicated that “the need for big pressure now is less than it was earlier.”

On the economic front, data from Germany showed that factory orders in the nation grew more than expected 0.6% (MoM) in February, on the back of strong domestic orders.

In the Asian session, at GMT0300, the pair is trading at 1.3699, with the EUR trading slightly lower from Friday’s close.

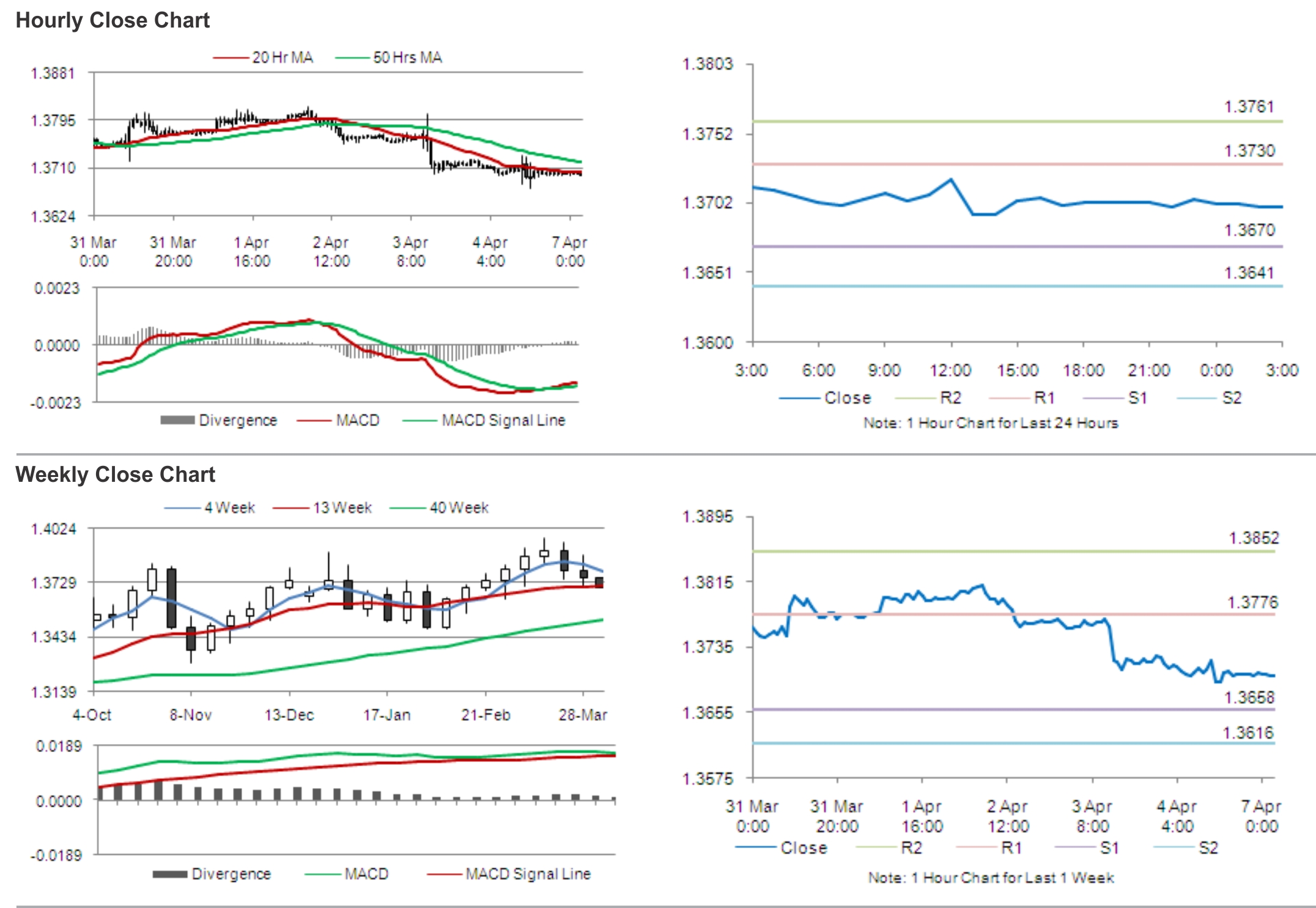

The pair is expected to find support at 1.3670, and a fall through could take it to the next support level of 1.3641. The pair is expected to find its first resistance at 1.3730, and a rise through could take it to the next resistance level of 1.3761.

Market participants keenly await the Euro-zone’s Sentix investor confidence and Germany’s industrial production data, slated for release later today.

The currency pair is showing convergence with its 20 Hr moving average and is trading below its 50 Hr moving average.