For the 24 hours to 23:00 GMT, EUR declined 1.21% against the USD and closed at 1.4036, amid fears that the Europe’s sovereign-debt crisis is deepening.

EUR was pressured as soaring yields on Italian bonds raised concern that Italy would not be able to finance its debt.

Meanwhile, in economic news, the industrial output in France climbed 2.0% M-o-M in May, from a 0.5% drop in April. Moreover, the manufacturing output in France advanced 1.5% M-o-M in May, from a 0.1% rise in April.

Luxembourg’s Jean-Claude Juncker has stated that the Euro-area finance ministers are studying the possibility of financing the purchase of Greek bonds in secondary markets as one option to help the country sustain its debt.

In the Asian session, at 3:00GMT, the EURUSD is trading 1.3960, 0.54% lower from the levels yesterday at 23:00GMT.

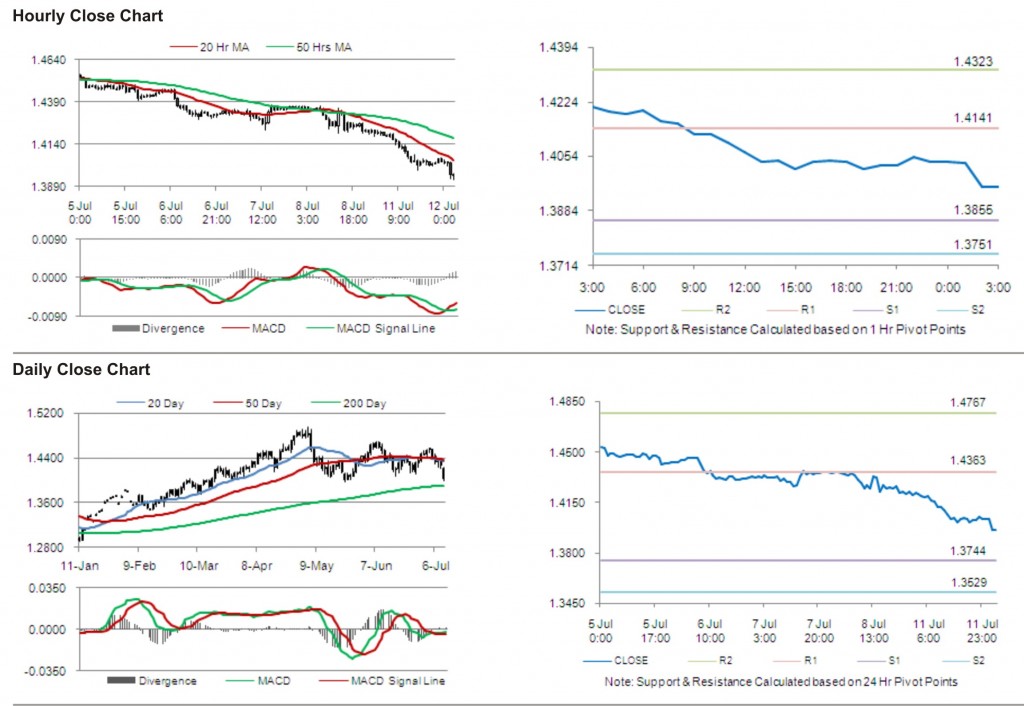

The pair has its first short term resistance at 1.4141, followed by the next resistance at 1.4323. The first support is at 1.3855, with the subsequent support at 1.3751.

The Economic and Financial Affairs Council meeting is likely to receive increased market attention along with other economic releases to be released in the Eurozone later today.

The pair is trading below its 20 Hr and 50 Hr moving averages.