For the 24 hours to 23:00 GMT, the EUR rose 0.42% against the USD and closed at 1.2058, following upbeat economic data across the Euro-zone which suggested that the upturn in the manufacturing sector would continue to surge in the new year.

The Euro-zone’s final Markit manufacturing PMI advanced to a record high level of 60.6 in December, confirming the preliminary print. The PMI had registered a level of 60.1 in the previous month.

Separately, activity in Germany’s manufacturing sector jumped as initially estimated to a level of 63.3 in December, expanding at its fastest pace on record and compared to a level of 62.5 in the prior month.

The US Dollar nursed losses against its major peers, as investors turned sceptical about the Federal Reserve’s monetary policy outlook.

On the economic front, the US final Markit manufacturing PMI was revised higher to a level of 55.1 in December, surging at its quickest pace in nearly three years and signalling a solid improvement in the health of the nation’s manufacturing sector. The preliminary figures had indicated an advance to a level of 55.0, compared to a reading of 53.9 in the prior month.

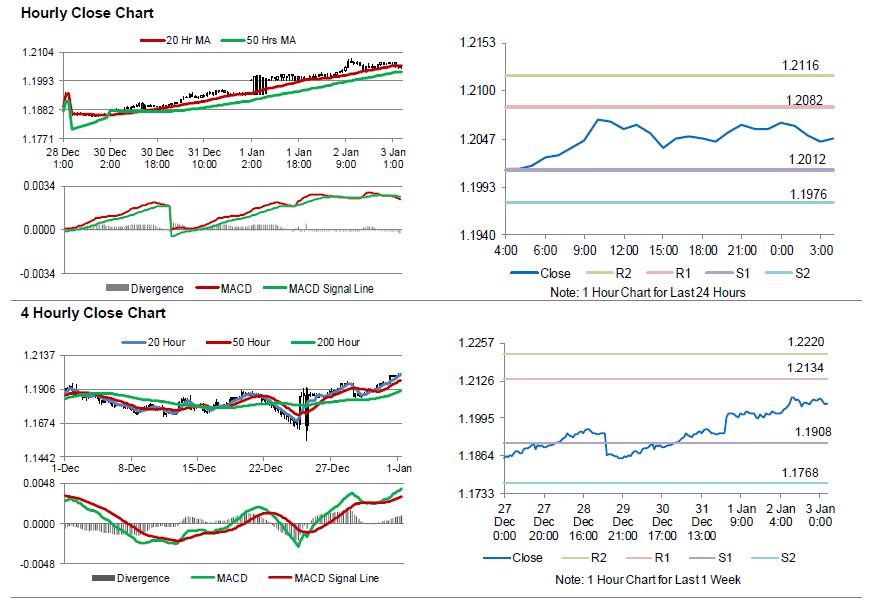

In the Asian session, at GMT0400, the pair is trading at 1.2047, with the EUR trading 0.09% lower against the USD from yesterday’s close.

The pair is expected to find support at 1.2012, and a fall through could take it to the next support level of 1.1976. The pair is expected to find its first resistance at 1.2082, and a rise through could take it to the next resistance level of 1.2116.

Moving ahead, market participants would eye the release of Germany’s unemployment rate data for December, scheduled to release in a few hours. Later in the day, investors will turn their attention to the minutes of the Fed’s December policy meeting as well as the US ISM manufacturing PMI for December and construction spending data for November.

The currency pair is showing convergence with its 20 Hr moving average and trading above its 50 Hr moving averages.